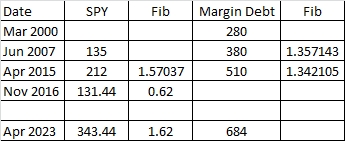

Margin debt grows with each cycle…from Lance Roberts-

Margin debt grows by Fibonacci levels 38% (approx.) higher each time.

From Investopedia-

Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction.

These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

Using the above margin debt as a guide and based on Fibonacci retracements, SPY could hit 132 at the bottom Nov 2016, 2 weeks after election. This would be a 62% or 38% drop level which is less than the 50% level seen in 2008. The drop will be less than 2008 due to inflation being low at this time when entering the recession / bubble deflation. The bubble will then be reflated for another 7 years leading to a new Fib level 1.62 times higher than currently or 330-340 by 2023 from the 132 bottom in Nov 2016.

TLT to SPY TLT:SPY ratio in 2008 got as high as 1.4. For a 38% fibonnaci level rise, 1.38 X 116 brings TLT to 160 in Nov 2016 or a 1.21 ratio to SPY.