Recessions occur every 8 years when inflation is low…

1972…73, 75..76 (high inflation), 1980…81

1984 (inflation high so 2nd recession), 1991..92

2000-2001, 2008..2009

2016

This explains why 2012 had no recession. Even Nassim Taleb mentions that the Fed has been able to control interest rates to which I agree. In 2012, the Fed started QE in Sep to stave off another recession and rebuild the labor force. It looks like the Fed prefers 8 years to rebuild the labor force after a recession when inflation is low. AND this is where we are now.. see link UC 20%+ in Reference section…

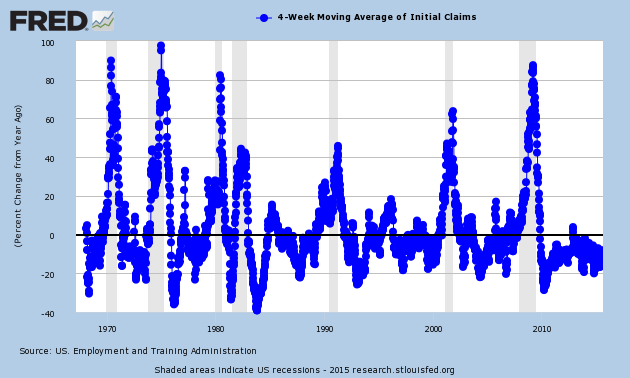

The above is the % change in UI claims from the year before. When it X 20%, you’re in a recession.

Inflation will remain low as prices are kept artificially high due to low interest rates, lack of demand due to excessive debt, and demographic trends. Due to low interest rates, asset inflation can be high at times followed by significant asset deflation in recessions. Asset bubbles will get bigger and bigger as the Fed drives interest rates lower and lower after every recession.

Therefore, you can expect recessions every 8 years until breaking point in 2038..2040.