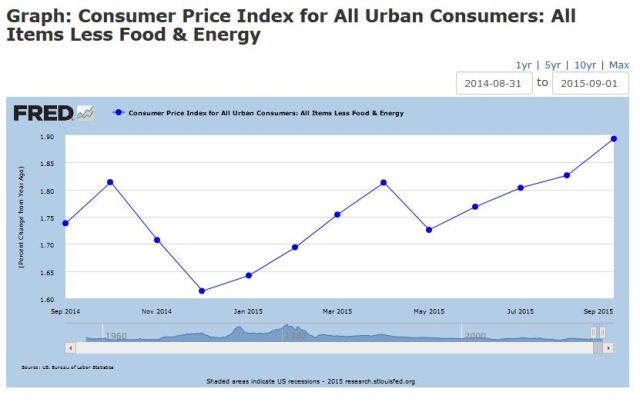

Few realize that rising core inflation causes the Fed to leave an interest rate rise on the table thereby suppressing SPY and causing this oscillation from 189 to 200. Last year it rose again in October and fell in November and December due to seasonality and rising prices just after the summer.

This year will be the same and the Dec Fed Meeting will signal no interest rate rise thereby sparking the Christmas Rally. January effect will take over starting Jan 4 causing SPY to fail again. The good news is that more oscillations cause a bigger run for TLT in January due to the Minsky effect or stability leads to instability (defined 2 ways below).

DEFINITION of ‘Minsky Moment’

When a market fails or falls into crisis after an extended period of market speculation or unsustainable growth. A Minsky moment is based on the idea that periods of speculation, if they last long enough, will eventually lead to crises; the longer speculation occurs the worse the crisis will be. This crisis is named after Hyman Minsky, an economist and professor famous for arguing the inherent instability of markets, especially bull markets. He felt that long bull markets only ended in large collapses.

Follow us: Investopedia on Facebook

At the time (in Dec. 2007), I described Minsky’s thesis like this:

[E]conomist Dr. Hyman Minsky points out that stability leads to instability. The more comfortable we get with a given condition or trend, the longer it will persist and then when the trend fails, the more dramatic the correction. The problem with long-term macroeconomic stability is that it tends to produce unstable financial arrangements. If we believe that tomorrow and next year will be the same as last week and last year, we are more willing to add debt or postpone savings in favor of current consumption. Thus, says Minsky, the longer the period of stability, the higher the potential risk for even greater instability when market participants must change their behavior.

Also Canadian dollar shows strength so TLT not a buy right now…RSI needs to be below 50 on Canadian dollar for TLT to be a bull opportunity. SO SPY nor TLT are good right now.