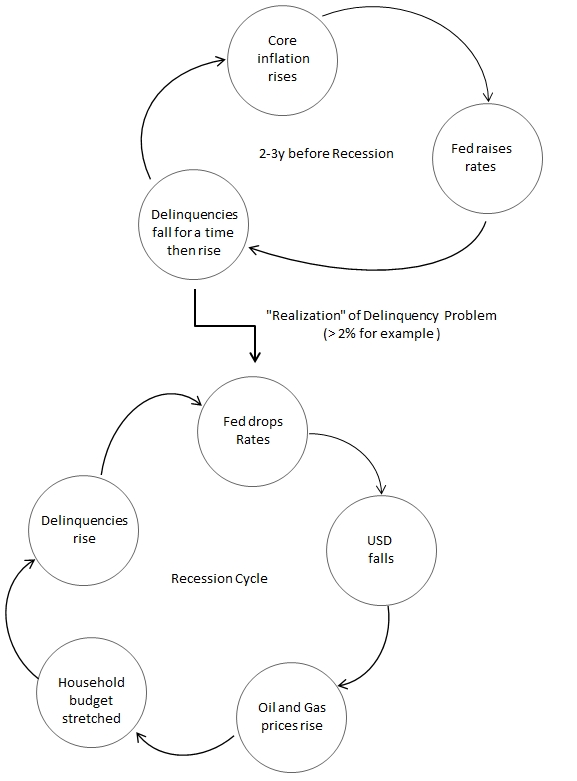

As discussed below, the macro adjustments for the recent recession are shown. From an individual level, the chart below explains it better-

Of course, we are in the 2-3y lead up to a recession at this time. But this is good news as rising rates leads to rising $USD and stalling oil prices as shown by MACD below-

The TLT: $WTIC chart has X already … an early sign of switch to risk off:

If oil X the 200dma by May, then a July 10% correction is possible.

BUT very unlikely,

Jul 2011 (GCPI 3.5% Q1 GDP -1.5%), and

July 2008 (GCPI 4.9%, Q1 -2.7%)

had high inflation/weak economies.

Economic growth Q4 at 1.9% and GCPI 2.1% now argues for a Sep-Oct run (July-Aug 2014 had a SPY fall of -2.5% only). On the plus side SPY will be very overvalued/overbought so a 10% correction is expected starting Sep 25.