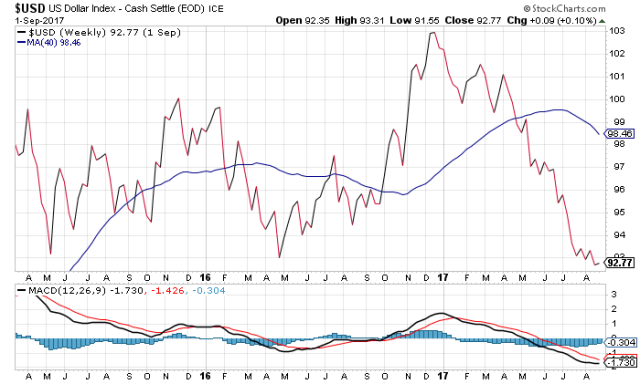

As stated in June, there will be no run (-10%) in Sep-Oct although a 5% pullback is possible over budget issues. The real reason for USD weakness is some inflation in the euro zone which has caused the euro to be overbought and the USD to be oversold. BUT as you can see above, the macd shows a return to USD bull again in 1-2mo. USD has been driving SPY of late due to the ‘speed’ of movement. Normally, it’s not the leading indicator but rather oil, and vix.

Due to USD weakness, SPY has run up and up but this is also good. The expected correction in January is now 12-15% . Oil will also get very low indeed by end of Jan 2018.

The low oil prices in Jan/Feb will also give an opportunity for a quick retracement in Feb-Mar (see Sep-Oct 2015 and Feb-Mar 2016).