Always you need a fundamental driver: Fed Mtg or CPI day.

- Watch for -1% down day on SPY after CPI day (Mar 13). Fed first day Mar 20 is also possible.

- And watch for the 4dma- dot, the day after at close. Buy at close.

It seems that a double dip is likely in Mar (after CPI day) due to high VIX (37) on Feb 5 as stated before as well as the 7 day persistence above VIX 20.

The charts below show weakness yesterday 4dma- and VIX 4dma+ also SPY -0.6% not a good sign. VIX has been above 20 for 7 days after the peak.

Now looking for first 4dma+ around Mar 13…

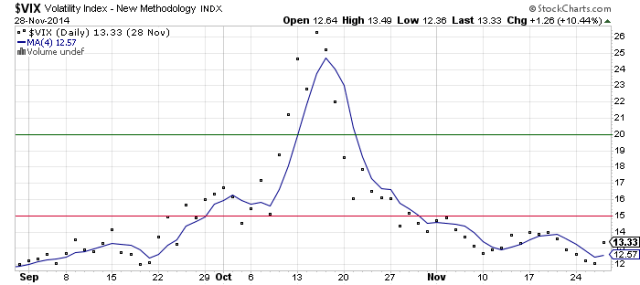

See last ROC M7 event VIX below. After the peak VIX, VIX did not persist with only 2 days VIX above 20.

Compare to Jan 2016: after peak, VIX persisted 7-8 days above 20.

And a minor event (Jan-Mar 2014), VIX persisted 1 day above 20 (after the peak) :

VIX goes higher as leverage is higher than ever and VIX got very low last year with no pullbacks!

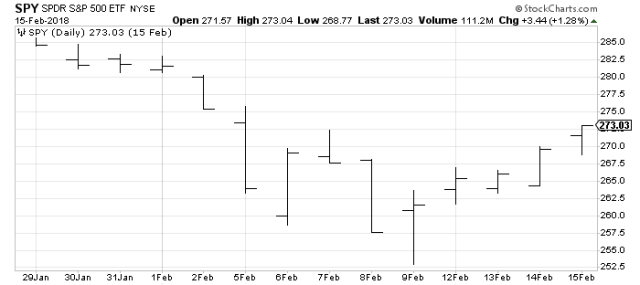

For reference SPY OHLC chart below, shows the bottom as Thu Feb 8 at close, sell point is obviously Feb 8 at close (open). It seems the sell point for these dips is always Thu at close. Mon (open) to Thu (close).