A lot of comparisons are made to 2008. AND most indicators are flashing recession ahead. The economy is slowing and weakening:

- Continuing Claims up YoY 6%

- Construction Cycle down YoY -10%

- Unemployment Rate up YoY +0.6%

- Vix 40wkma up

- Fed has dropped -0.75.

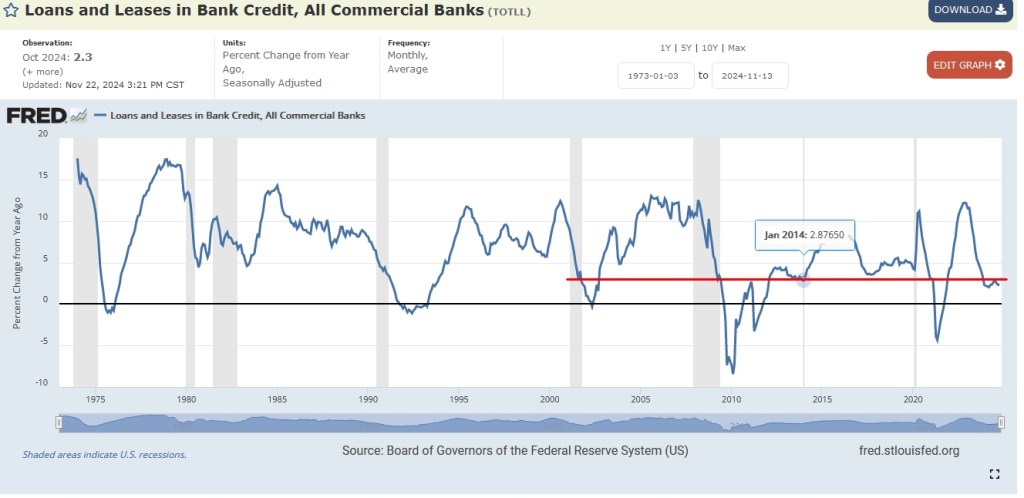

- Bank Credit has slowed below 2.7%..the last low.

- Market is 0% next year (2y cycle, VIX at 14, construction at 2006 levels, OEX flat, UR still low)

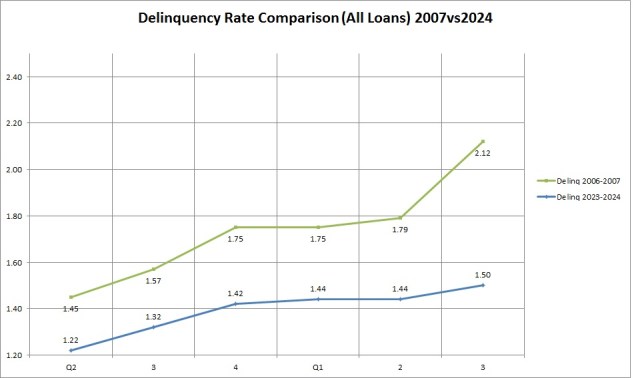

In 2007, payrolls were growing below 1%…we’re still at 1.4%. Below 1% will be next june. Notice Q3 2006 started at 1.5% delinquency rate..the same as now. Vix was 20 in 2007…now 15.

Hence, it’s a 2-3 year bear market not ONE as in 2008.

Ever since 2008, there’s been a 2 year cycle. One year down for SPY followed by 2 years up and another year of 0 or minus. In a recession, it would be 2 years down.