The Fed says no more than 2 drops next year 2025.

They said the same in 2023 about 2024 BUT had 4 drops.

So Fed is still concerned about inflation

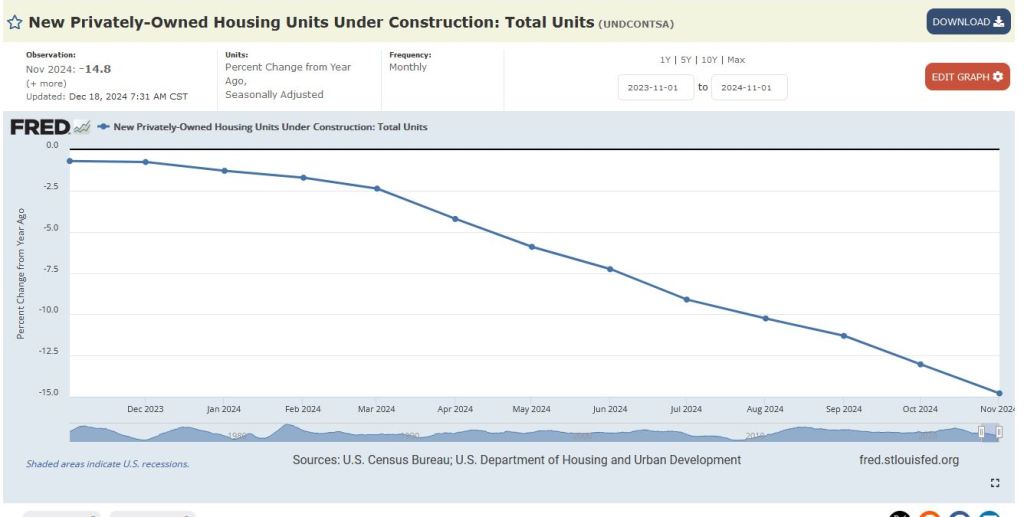

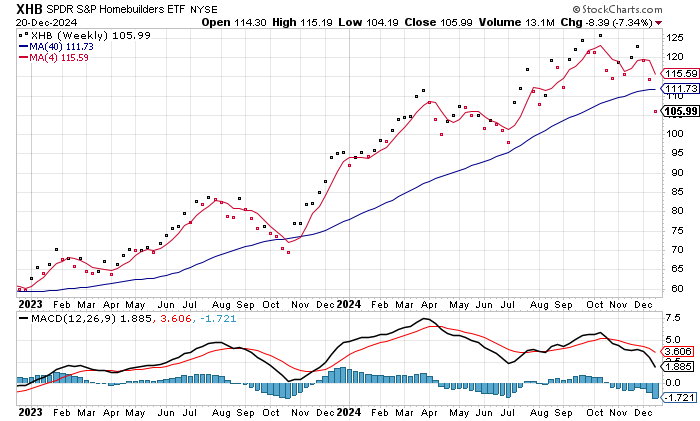

BUT construction continues to fall and rising unemployment 2025 will create a big crisis in late 2025-all through 2026. M1 money supply indicates a drying up of liquidity for 2025.

So Fed becomes caught between a rock and a hard place.

Cant drop rates too quick BUT the economy-construction keeps falling and cant be stopped AND mortgage market money supply remains cut-off.

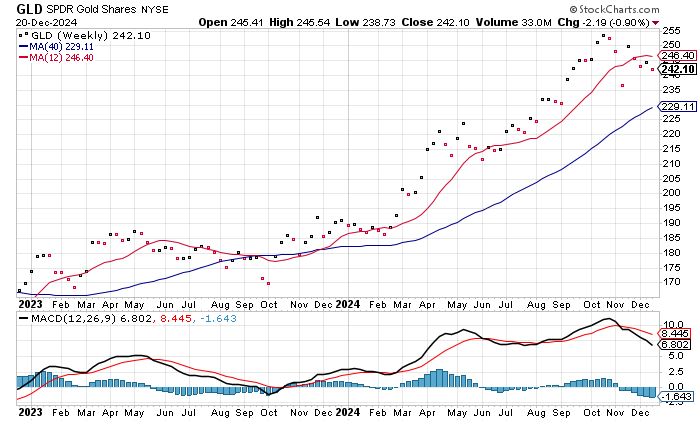

BUT gold shows the inflation cycle has rolled over…

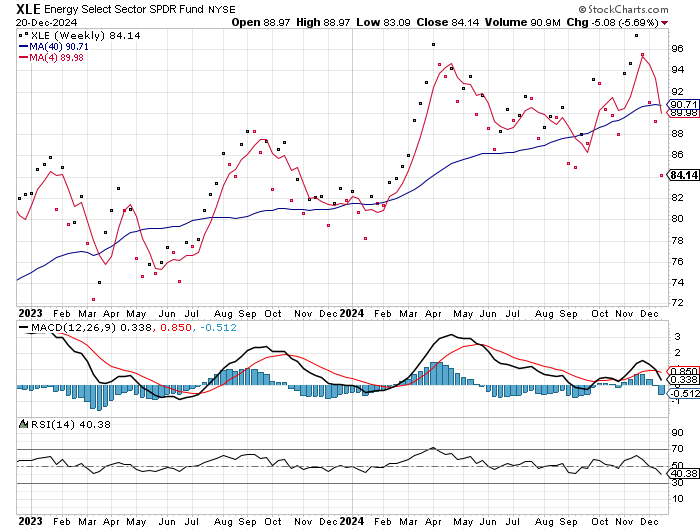

AND XLE starting bear

In 2024, there were concerns of inflation from Jul-Oct. BUT Nov-Dec show a new bear cycle.

AND LASTLY THE FED CANT SAVE THE DAY…