The Fed does not look ahead. It always looks back fighting ‘inflation’ now instead of worrying about next year.

But bonds have been quietly moving up since mid-March as growth has been dying. Short term inflation will have less and less effect on bonds moving forward.

Feb inflation in Europe was 1% but the bonds moved up anyway.

Bonds are still waiting for the first cut before ‘breaking out’. And eurodollar university says which I agree with

the Fed always does a flip-flop.

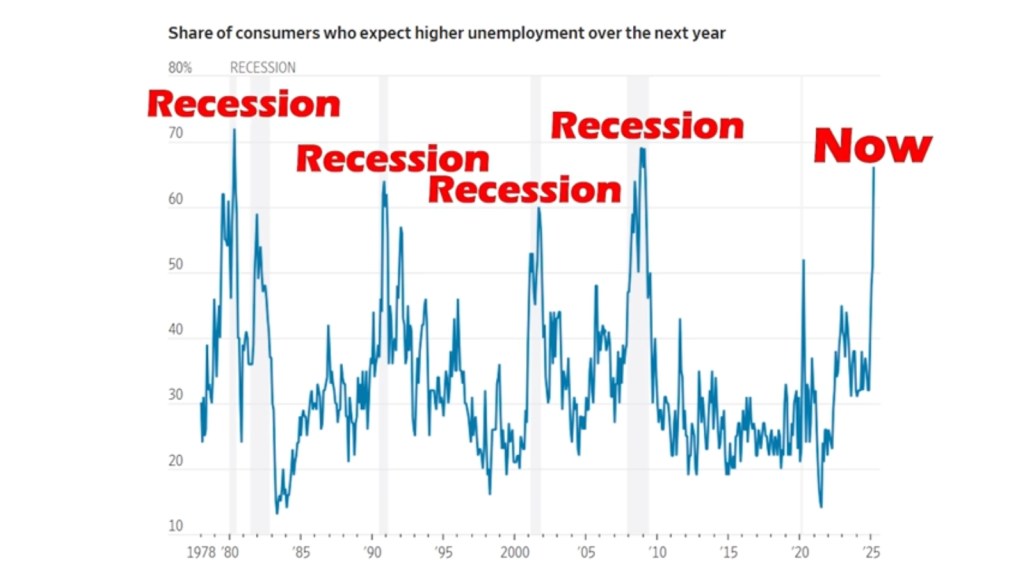

I have looked at consumer sentiment over the years and its basically useless.

BUT job sentiment appears to be the significant part of michigan sentiment before a recession…

Note how high this is BEFORE THE RECESSION!

The kid overstates everything BUT this job sentiment IS SIGNIFICANT.

JOB layoffs at government will account for less than 0.15% of payrolls

BUT this sentiment indicates the majority are now worried not just Federal workers.