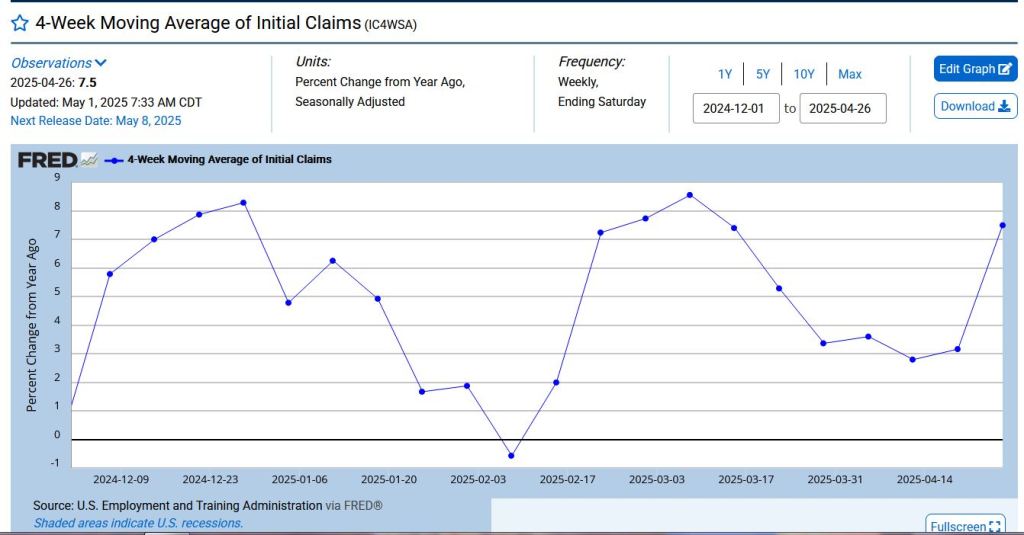

Since stocks have been rallying from last July-Feb 2025, notice that claims have been flat. Unemployment rate (UR) follows.

Now that the stocks are in transition with market down -3% (by 3rd wk Dec) this year as opposed to +24% last year, and the recent hiccup Mar-Apr…claims start to rise again.

Even 2023 rise came from stocks -20% in 2022…

Initial Unemployment Claims also rising again…

Stocks continue rally to mid-July now…anticipating the cut….up on the rumor down on the news.

Spy will be 593 by 3rd week of May OB then small $20 pullback by end of month.

It will be a little bit above 600-605 by mid-Jul but not a new high.

DHI breaks out as predicted…

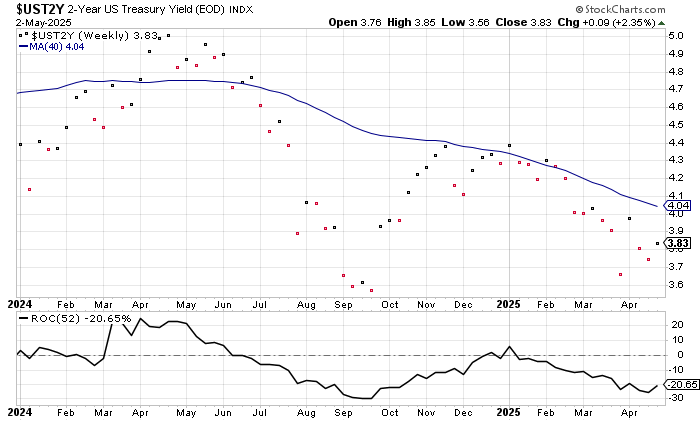

Also 2y Treasury got ahead of itself…now moving back to 12 week moving average…

by mid-Jun can return to 3.58…

Since last year…