Despite rates being dropped, spy continues to lose upward momentum…

1 and 2 y Treasuries suck away money from SPY and then it hiccups.

The last 5 weeks of 1 year Treasuries show money being drawn away from SPY

and is the best leading indicator.

5 RHA bars on 1 year Treasury corresponds to declining momentum on SPY as seen in flat macd bars

and bi-wkly average prices losing momentum.

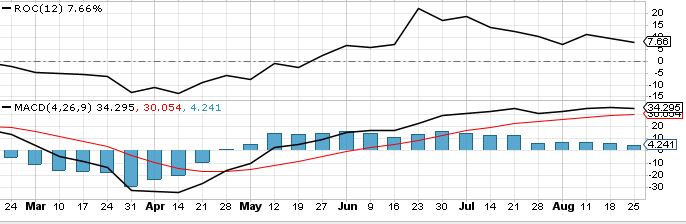

Above chart more clear but below 6mo SPY wkly macd (4wk) also shows it…

AND the same for TLT:SPY near a cross…