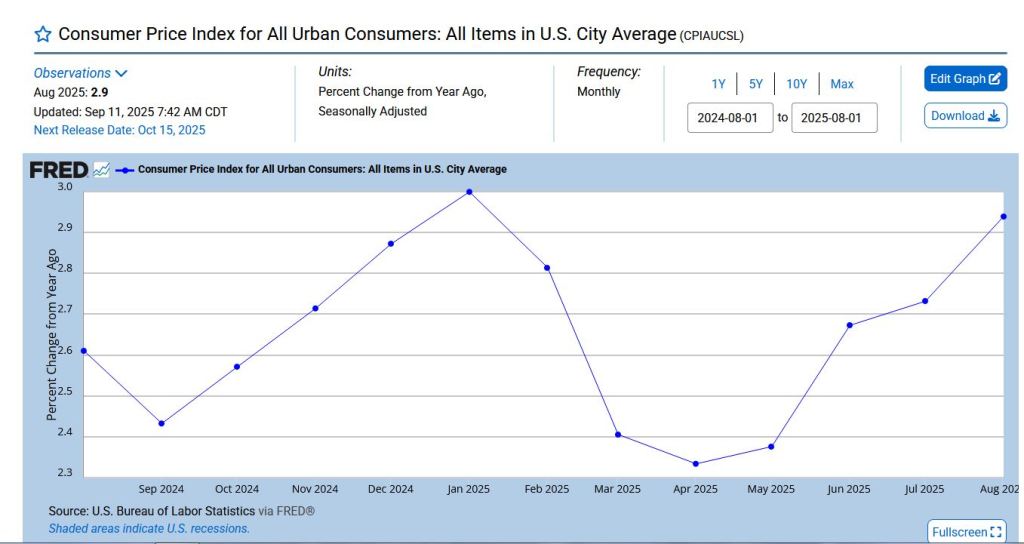

AS inflation surges, growth dies. Recessions are built on inflation and negative growth.

As the Fed drops rates, inflation surges killing growth.

But IF THEY DONT DROP, GROWTH DIES EVEN FASTER.

THEY ARE CAUGHT BETWEEN A ROCK AND A HARD PLACE.

In a recession (very special times), bonds now disregard inflation and

respond to falling growth/recession.

IRONICALLY, inflation is now our friend.

AND stocks don’t like negative growth and rising inflation. (also wages can’t/won’t keep up).

AND monthly CPI surges big…

BUT FED has to keep dropping…see 1year Treasury below.

3.6 on 1 year factors 2 drops…or 4.3-3.66 = 0.64%

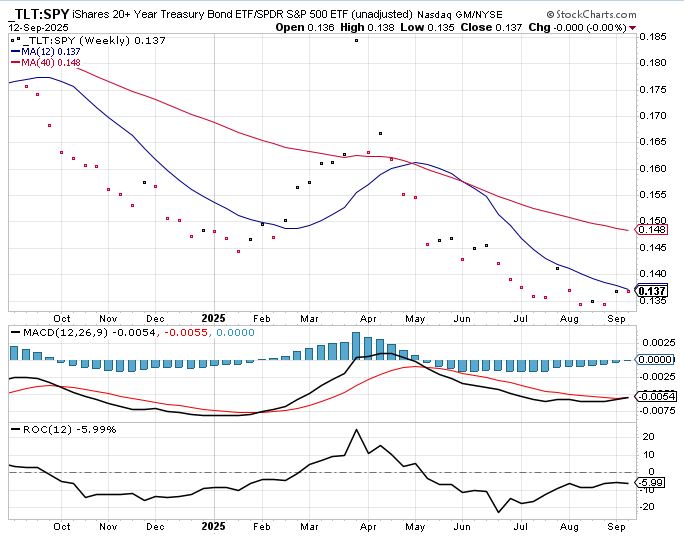

TLT now a bull with 6 days above 200dma…like June last year. MINI-RUN now complete.

AND TLT to SPY closer to cross…

This policy leads to spiraling inflation and crashing economy.

OF COURSE, the only way to crush the inflation is to have a recession and deflation.