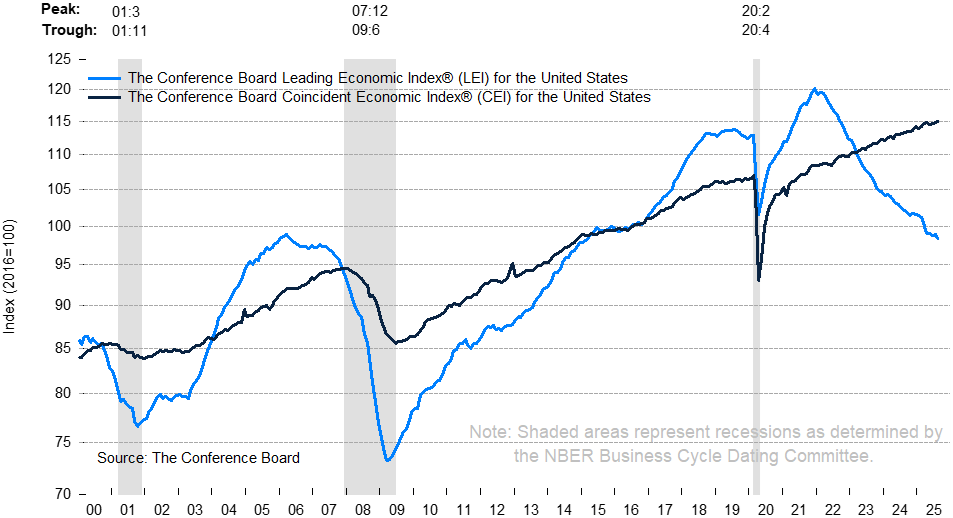

The decline from lei highs has been very long. Oil also falling slowly $10-12 per year.

The bull market in real estate has run from 2012 to 2025 or 13 years and stocks you could argue have been running since 2009 or 16 years.

Normally a bear market is 33 % of the bull. 2008 was one year out of 2003-2007 (5 years) so 20%.

Because of the big stimulus and rise, it will take longer to fall to recession than before.

And 20% of 16 years is 3 years. The first year down will be a ‘low growth’ economy.

HIGH ASSET PRICES have been driving everything which even jp now talks about being too high.

High prices lead to a ‘stall out’ versus a rapid inflation and crash.