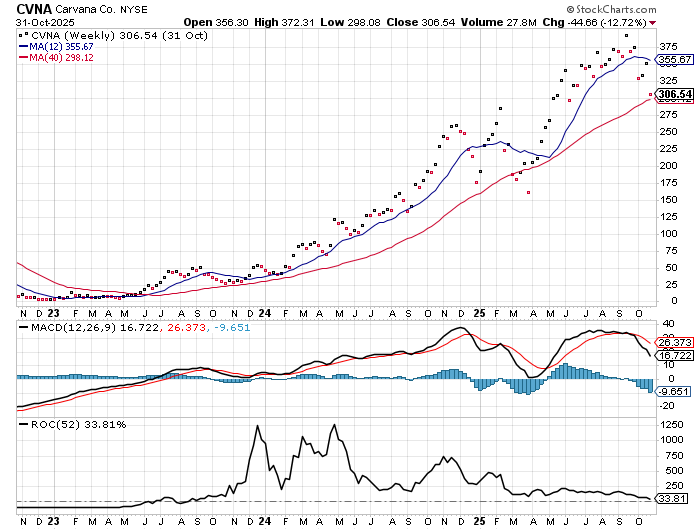

Looks like Fed is becoming worried about this parabolic behavior of tech stocks.

Hence, why no drop in Jan…regardless of rising unemployment or lower inflation.

Tech and Gold stocks thought rising unemployment was great for them as Fed would drop rates downwards in a straight line.

In Oct, drop was -18%. And there was a big signal the last 2 weeks of Feb before the big drop in Mar-Apr -42%. Last year ytd Oct +390% and this year +61% YTD.

Notice it slows in Aug then sideways Sep then fall -18% in Oct…

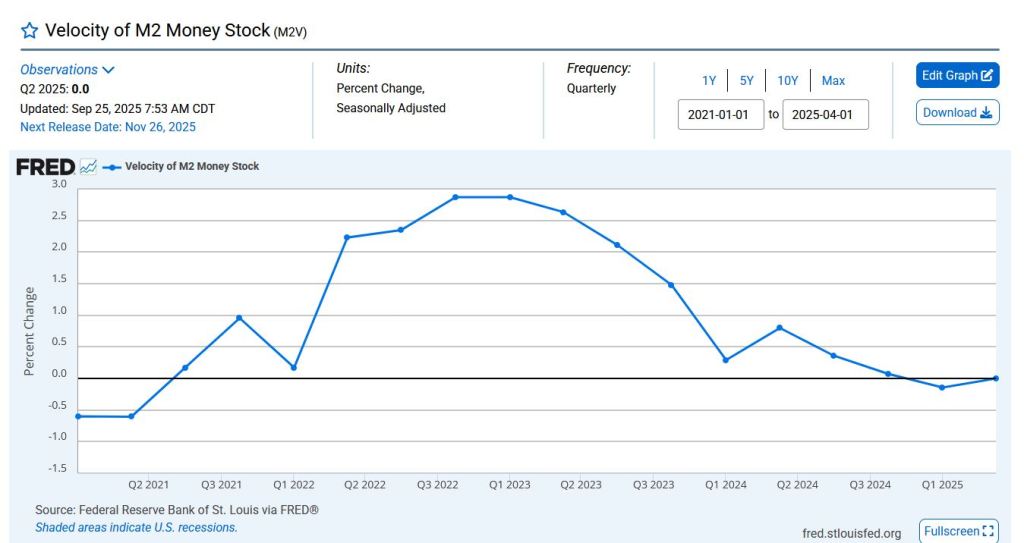

OF COURSE, money velocity has died from the peaks of 2022!

With large debts and high prices, asset deflation over 3 years is the outcome

with many prices also deflating. CPI deflation will occur at the end of 2028 just before QE.