Hoenig stated too much stimulus and QE created wealth gaps leading to 2016…

BUT be careful of perma bears who were wrong in Dec 2021-

Lacy Hunt

Juggling Dynamite

and Rosenberg

Hoenig stated too much stimulus and QE created wealth gaps leading to 2016…

BUT be careful of perma bears who were wrong in Dec 2021-

Lacy Hunt

Juggling Dynamite

and Rosenberg

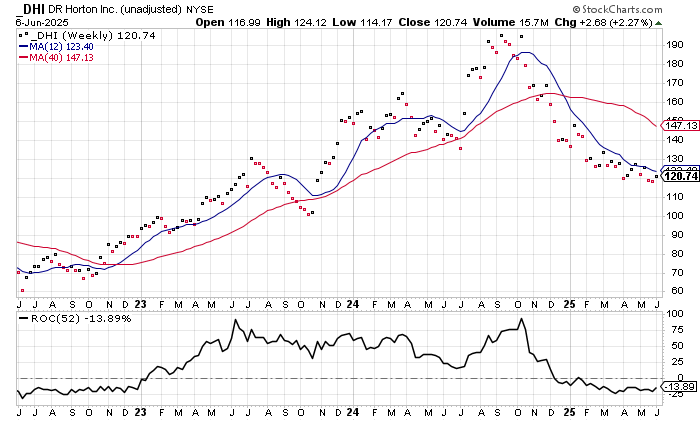

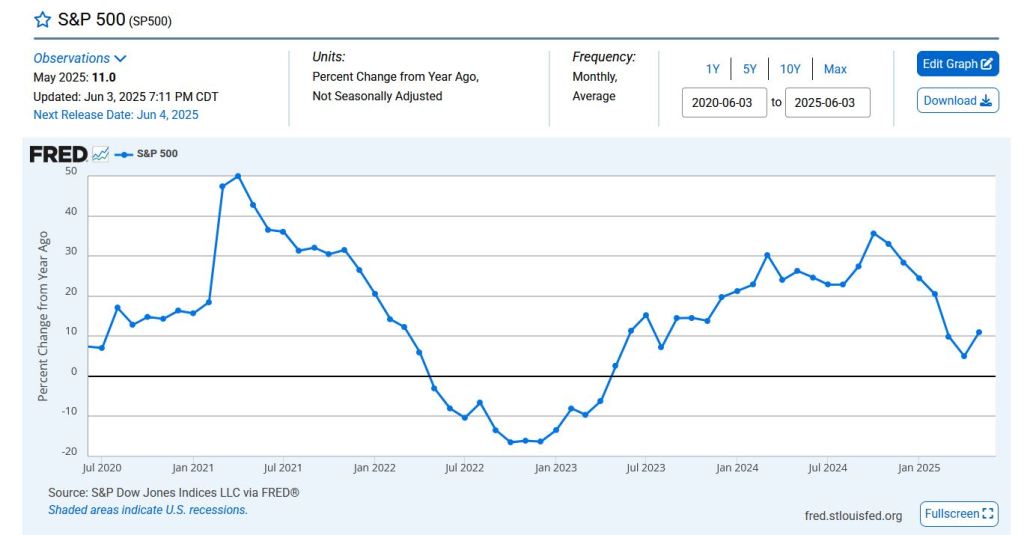

Normally DHI would participate in a big rally with SPY.

But it’s just a simple bear market as real estate worsens…

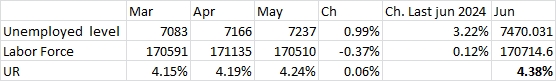

The rounding has favored 4.2 but the actual numbers are below…

Based on last june a big jump is coming…

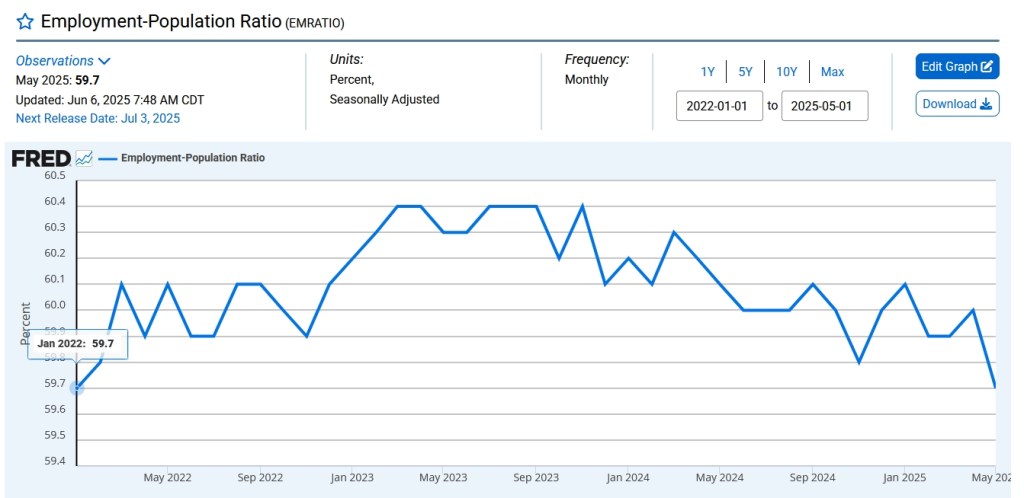

Labor force has been shrinking and empl to population ratio has dropped to 59.7

same as Jan 2022…peak jobs was late 2023…

The second biggest monthly change in 3 years!

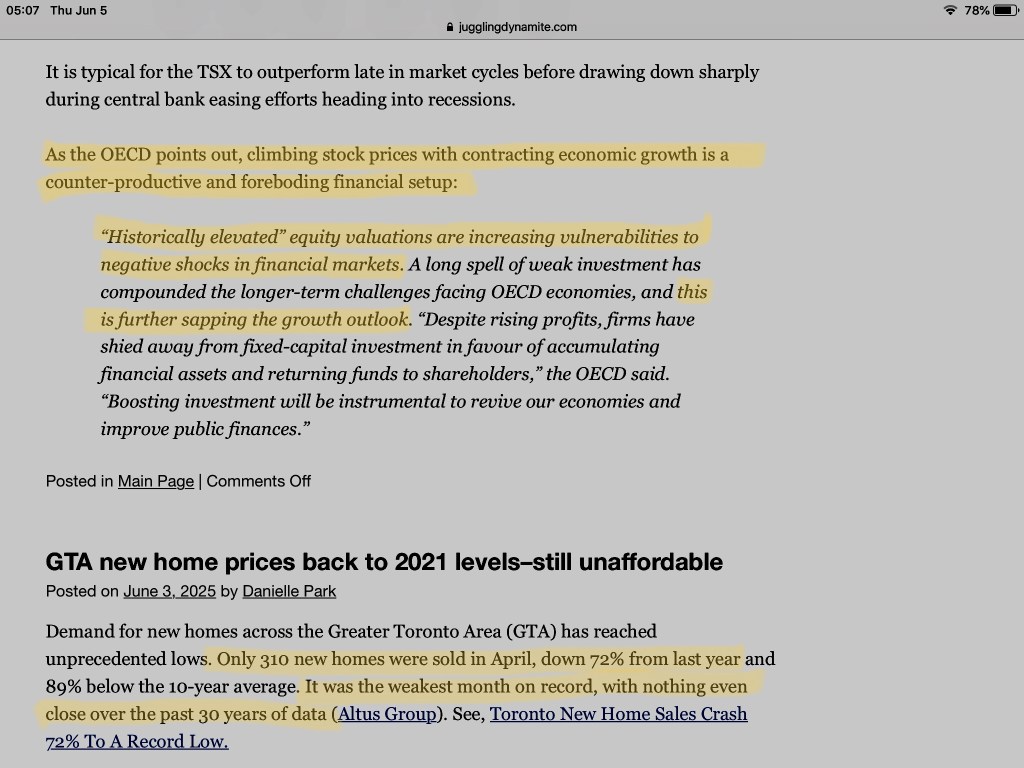

OECD quote….

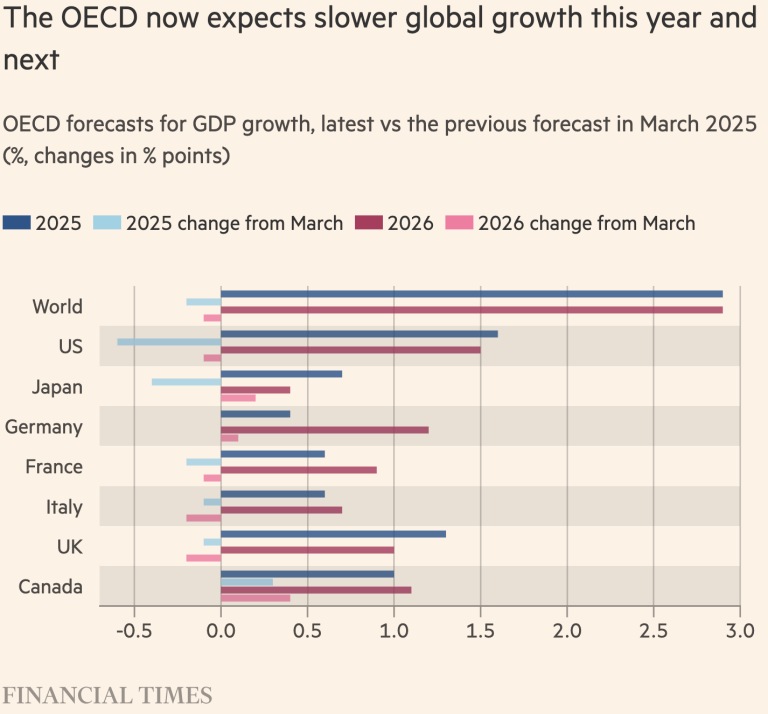

You can’t trust these guys’ forecasts. Look how much the forecasts have dropped in just 2 month…-0.7% for US…

Completed construction crosses the -10% threshold in April like 2007…

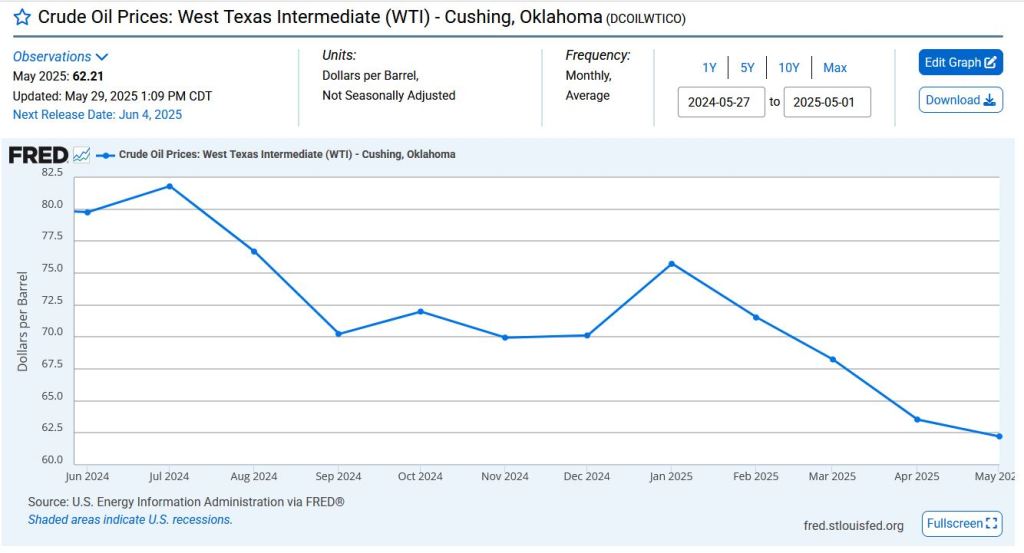

Economy weakening…Once again, Jan 2024 bullish but by Mar 2025 bearish as well as oil…

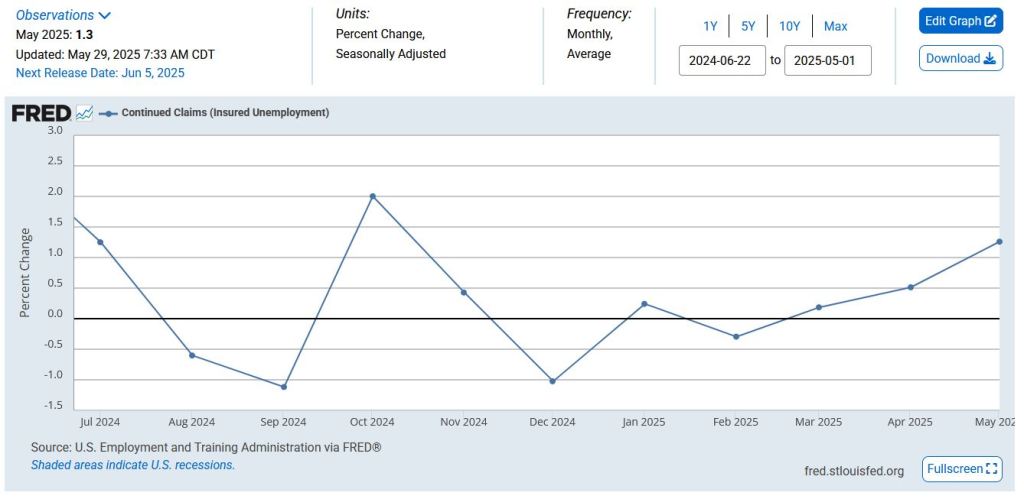

AND monthly claims bad…

IT ALWAYS takes time for optimism to come off…since april it has been accelerating…

https://fred.stlouisfed.org/graph/?g=10m6s

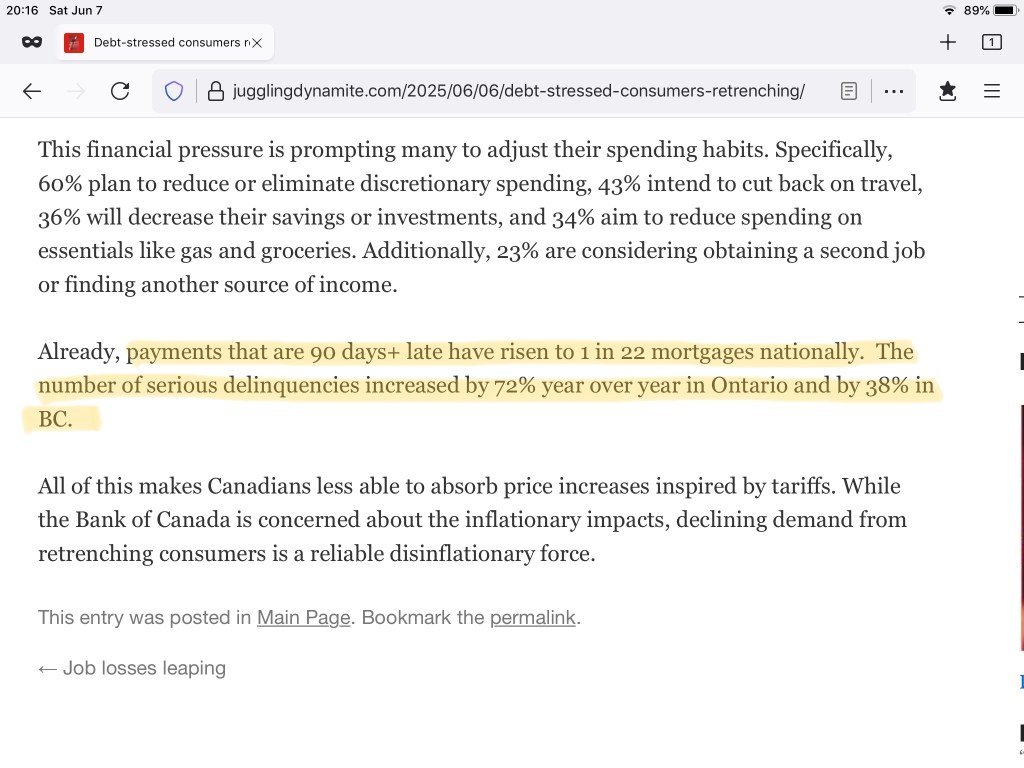

BUT of course, it won’t spread from there!

Only 1 year into downturn and new homes discounted by 30% Florida like Toronto condos…

AND yes I already knew that builders continue to build into the downturn

but less and less using up already purchased land at lower and lower prices

and YES better materials will be used as well.

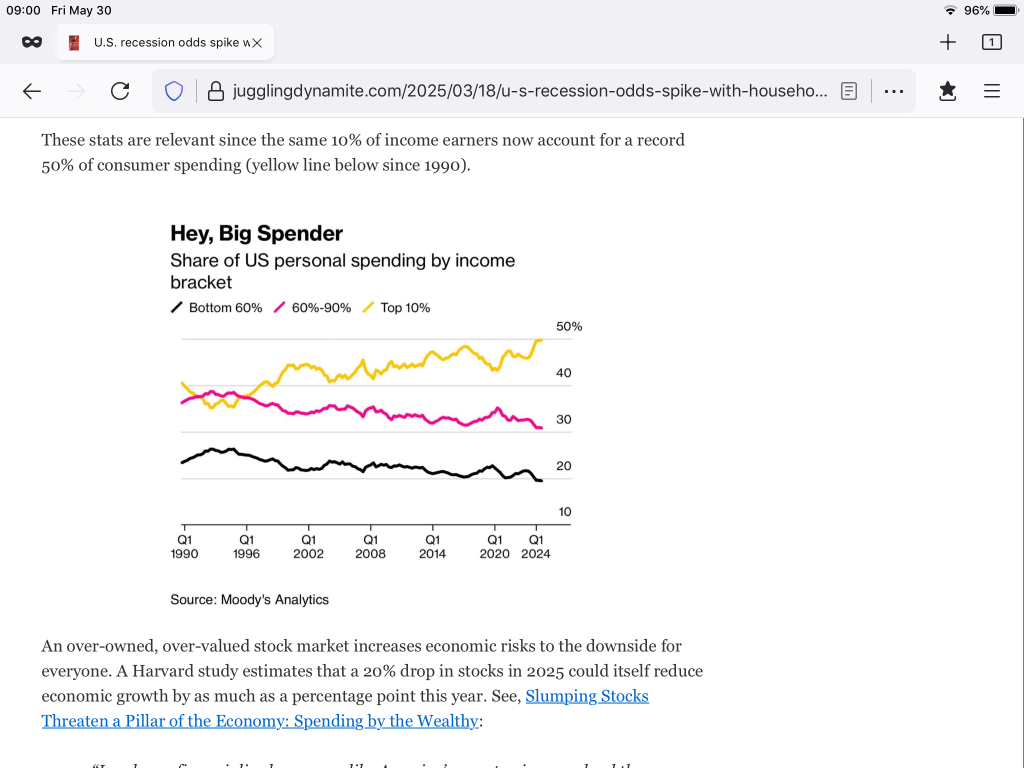

ASSET PRICES lead the economy as I have been saying for 10-15 YEARS!

For example,

10 spend $50 or $5 each

60 spend $20 or $0.33 each

RELATIVE SPENDING of top 10% to bottom 60%

=5/0.333=15 times !!!

In 20 years, it will be 70% of spending and bottom 60% will be 12% or 35X.

AND PEOPLE CALL ME AN IDIOT WHEN I SAY FDR IS COMING!

I say in 20 years he’s coming (when money velocity hits zero). What does it mean?:

top tax rate 90%, capital gains rate 75%, banning of gold ownership, etc…

maybe even wealth tax like Europe…

From Ed Dowd below,

Risk off….trade of the year US Treasuries bonds.