Last week UTWO started the move…this week IEF.

Mar-May upward slope….

Quote from sidebar…

Much lower than today. Landlords need to know that rents are FALLING in Southern Ontario, same in Vancouver although not as bad.

So many reasons: Bad Economy, Immigration Reversing, The End Of Airbnb, the Great GTA Pre-Con Condo Crash, Massively Increased numbers of new Purpose-Built Rental Towers coming on stream. Honestly the outlook for some Landlords is grim

I liked her back in 2007 and 2008 even 2009…some recent links…

She was the only one I would see at gold bug conventions as she was the only one there who liked US treasuries.

I believe it was the massive real estate bubble that drove immigration to Canada the last 20 years…

She talks a lot about housing being the key to recessions.

“Bear markets, it is said, are periods when assets are returned to their rightful owners–strong hands take back from weak. And so it goes, cycle after cycle. This time is not going to be different.”

From her blog Apr 25th, CRUNCH+SURGE-

my comment…CRUNCH wk2 APRIL THEN BUYING SURGE wk 4 APRIL:

Below is why they are now cutting immigration, refugees, and student work visas…

Already worse than 2008 !

AND NOW is she good in risk on? NFG… WAY OFF in 2022 !!!

Notice on May 1 the utwo moved FIRST then IEF followed.

A key concept is ‘negative wealth effect’.

The XHB downturn leads the economy and leads to ‘negative wealth effect’.

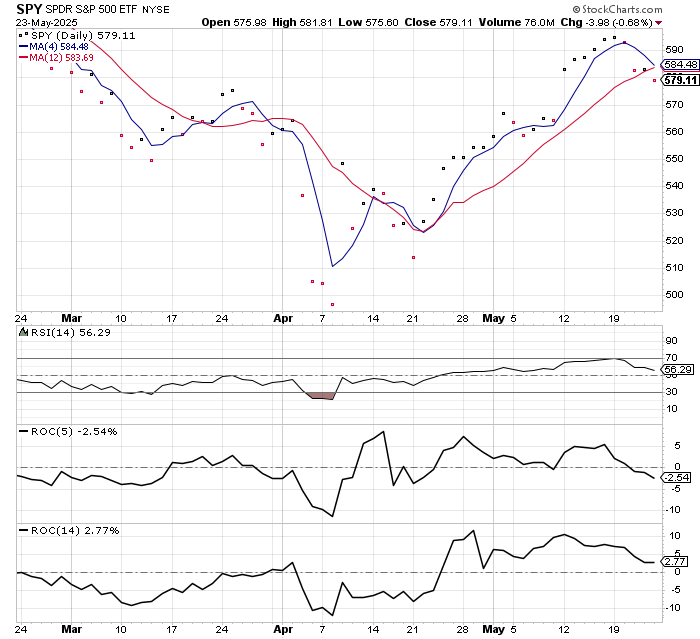

Here you go…OB at 594 on Monday and then began selloff. THIS is a sideways/mild bear market.

No more BULL. THE MARKET DETERMINES THE NEWS NOT THE OTHER WAY AROUND.

Tariffs were also big news in 2018 but did not matter. The ‘deals’ did not materialize and macro problems came to the fore and stocks went down anyway.

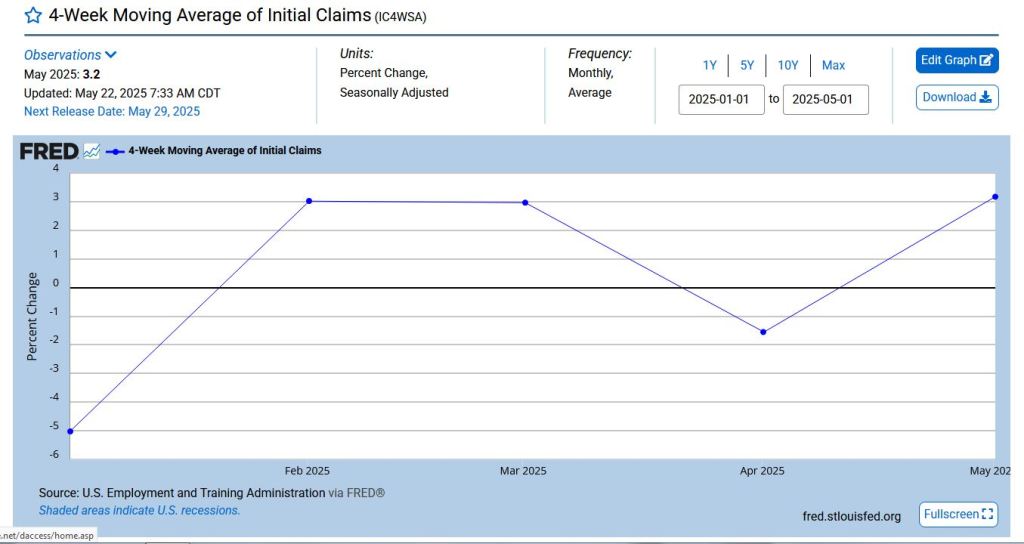

Downward pressure on bonds will start to come off with unemployment rate first week of June. Of course, you have 3 days down with bs payroll numbers when hedge funds sell.

However, it’s bought back and more the next week.

AND wall street doesn’t like Mr T budget. I guess the Mr. T magic has worn off.

Once again, it was predicted that 2nd term will be a disaster. Poll ratings are already below 50!

SPY +88 points +17.6%

IEF -2.9 or -2.9% off high so QUITE RESILIENT ! 1/6th…

Oil Rigs cracking…I guess the $65 per barrel break even price seems to have merit…

lowest level since Nov 2021…

When IEF remains in negative territory for 4 weeks, the turn around occurs.

Last time was mid-Dec to mid-Jan…waiting for 12dma to cross…

I figured out the youtube guys are real estate agents who take big commission checks when real estate is booming

and switch to gold (also high commission) when real estate turns down!

Not a bad business strategy for sales people though.

Real investors are not on the internet!

The worst is Citibank model at 6.7% unemployment rate. The range for Q1 bank statements is 5-6.7%.

And JPM increased the most by $1B.

To me this is just the beginning…every quarter forecast gets worse and worse from here on out…

AND claims rise again in May…

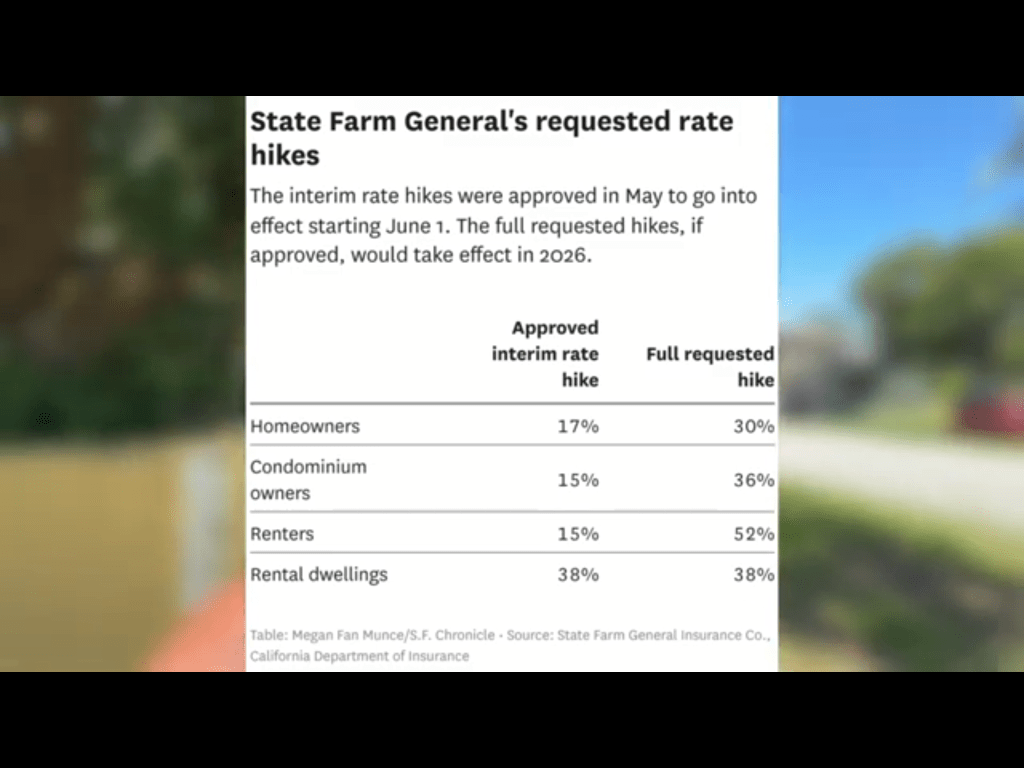

And insurance rates +15% California…

Here’s a list of indicators that did not work. after-action report.

Many of these indicators are traditional BUT DID NOT WORK…

Some may work again given that the 50 year super-cycle bubble is bursting.

AND JP has to keep rates high for longer because of his fukups in 2021!!!

Of general background assistance,

What has the last 2-3 years taught us? Don’t listen to perma-bears when risk is ON and vice-versa!

While in Risk Off for the next 2 years, it’s OK to listen to perma-bears.

However, ONCE RISK ON RESUMES AT END OF 2026! DONT LISTEN TO THEM!

Bad numbers will be a problem for 2025-2028…rising unemployment, weak economy etc…

AND REAL ESTATE-SPY will be in the dumps for 5-6 years.

But listening to perma-bears in 2013, was very lethal to GOLD BUGS! In 2013, SPY was the absolute winner and real estate began to move.

This is the basis of the 2Y RULE! No perma-bulls or perma-bears are allowed!

AND all dowm’s are perma-bears with one foot in the grave! I DONT LISTEN TO THEM!