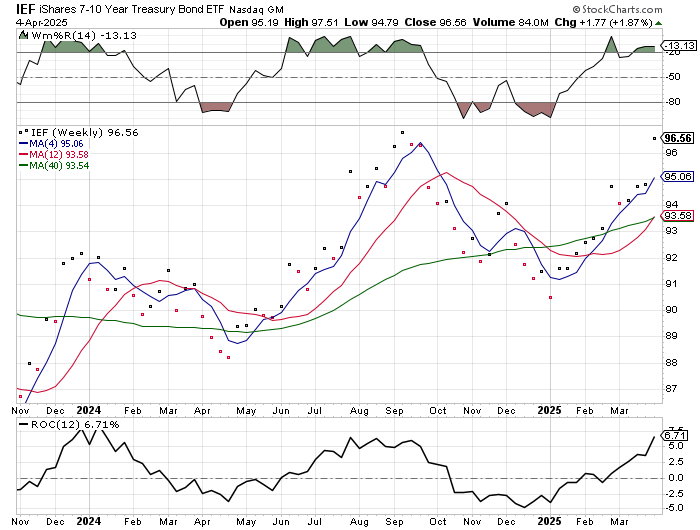

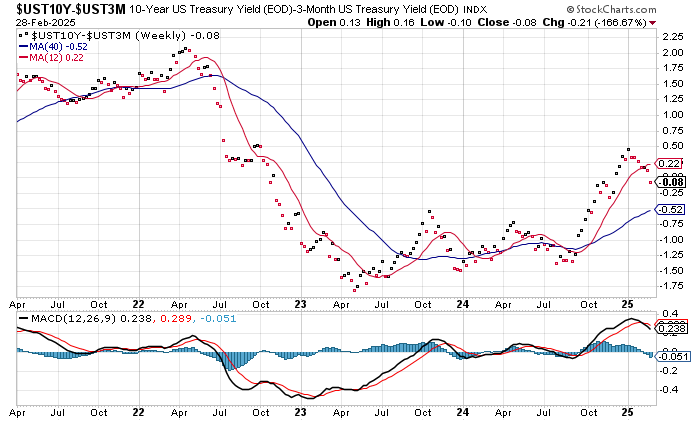

Bonds are green. Clearly, they are starting to factor in recession (negative growth).

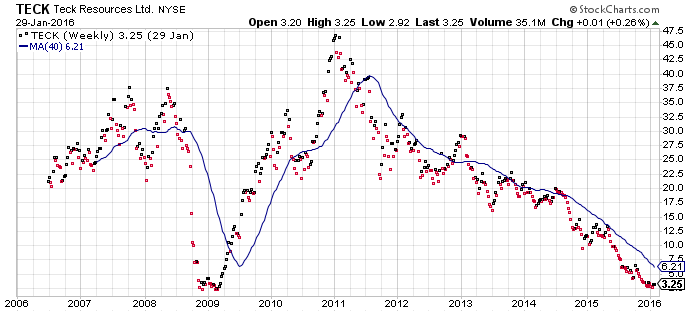

TECK shows weak economy -26% for 2 year change..

Bonds are green. Clearly, they are starting to factor in recession (negative growth).

TECK shows weak economy -26% for 2 year change..

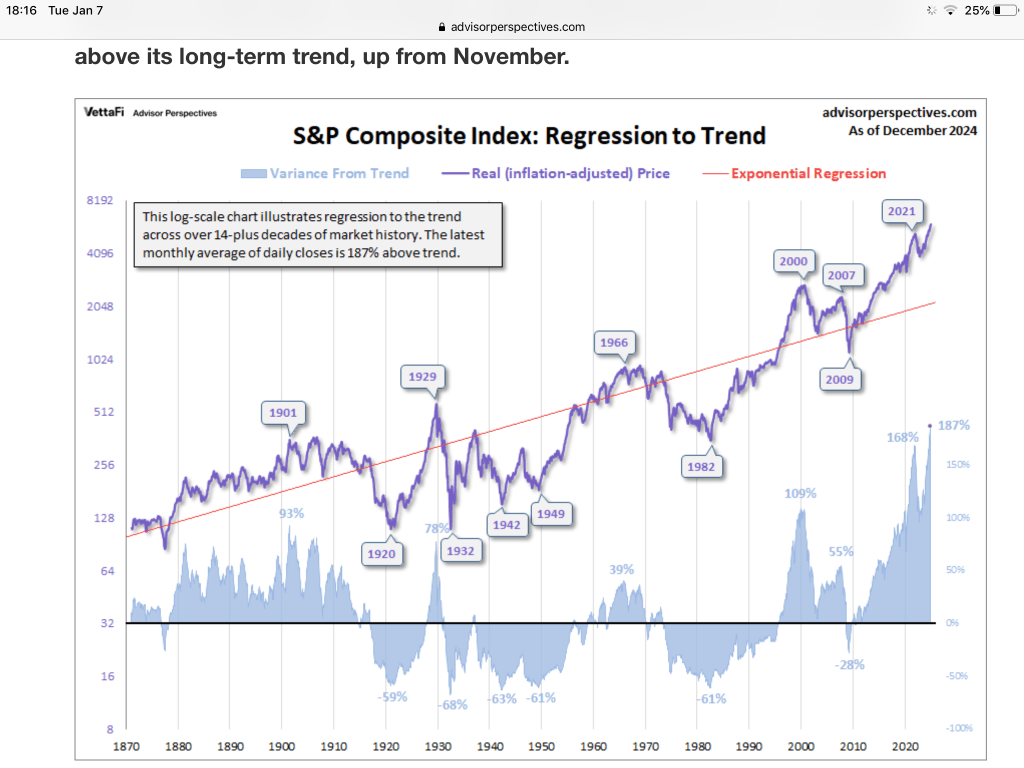

Stocks and real estate are dead for 4 years during the cleanup.

See that housing and gold are inverse. When housing started to recover in 2012, and

XHB was +50% YoY.

GLD went sideways and then crashed in 2013. GDX return same as GLD…

GLD 2.4X vs 2.7X.

Also OEX hit 0 at last bottom…and showed downtrend at end of 2014!

TECK up also 2 months after QE starts.

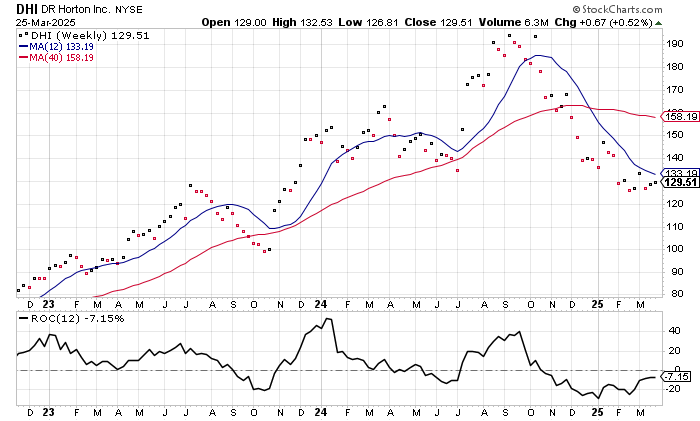

By 3rd week of july , DHI will rebound back to 200dma.

More up momentum will occur in weeks 2-4 in April, May, and Jun. Then roll over in Q3 and Q4…

Fed drops rates in June.

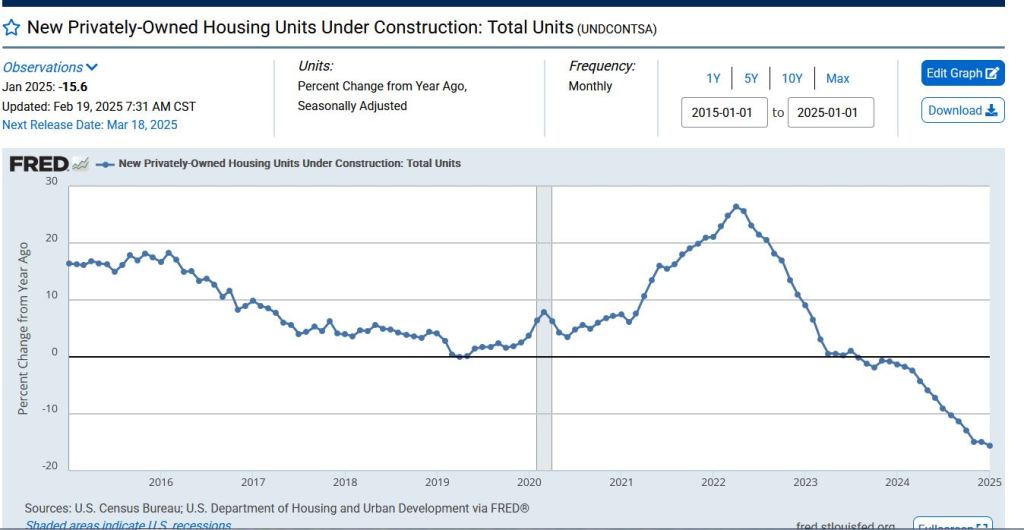

First, units under construction in decline…

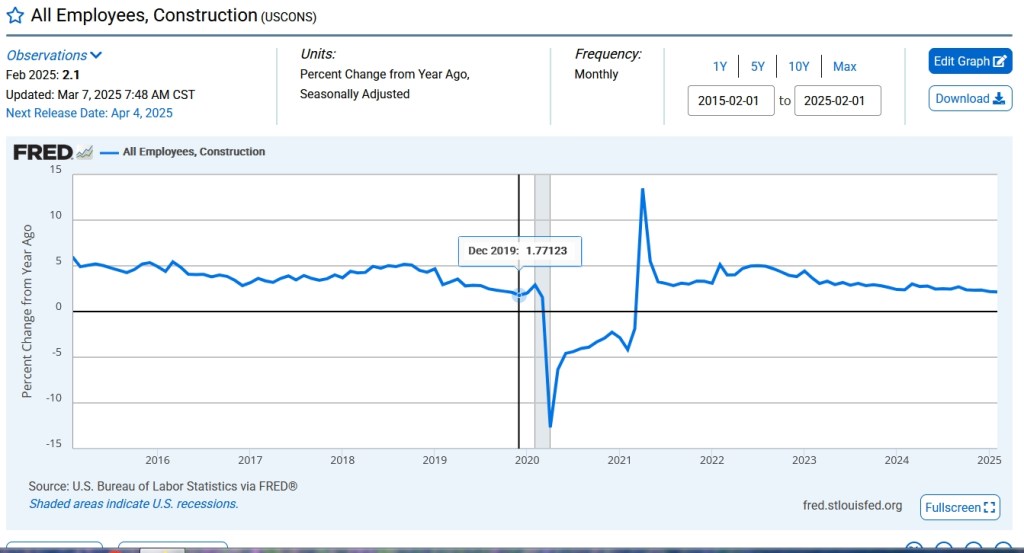

Second, employee growth the lowest since covid and 2019…

the last year…

the last 10 years…

Homebulding stock in bear market for 3 months now…NOW down YoY -2%

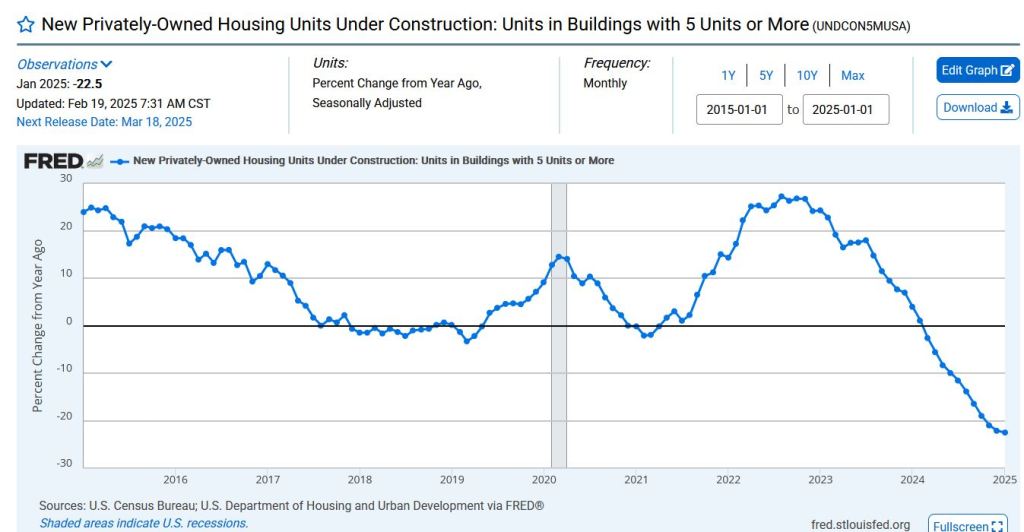

AND apartments/condos down even more…

down this year again after 2023 and 2024

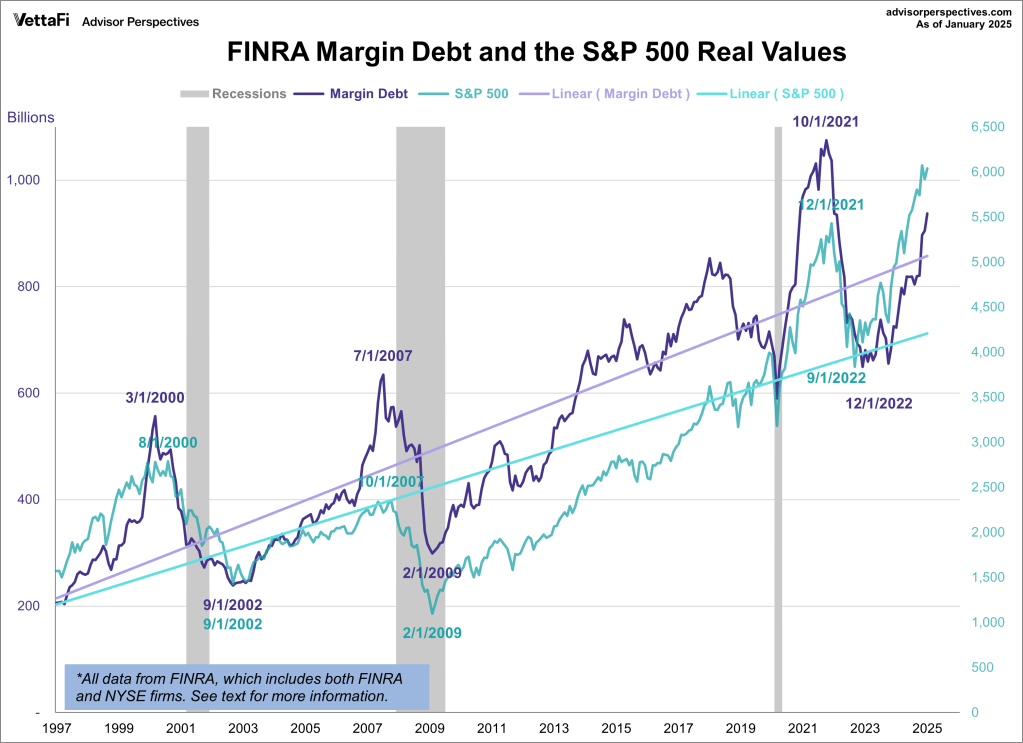

Margin debt near all time high…at least 50% more than 2007 peak…

Exponential regression to trend puts S&P at 2100 but by end 2026 SPY 240.