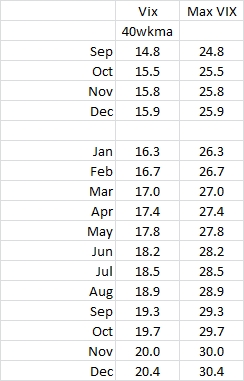

gasoline prices were falling less fast on YoY basis…now reversing..

SPY slope…what is spy at by end of March?

4 wkma 2.33 per week…mar 31 …620

12 wkma 1.20 per week …..mar 31 607

Between two…613.3 or 4.7% or 1/2 the rate of last year (10.4%).

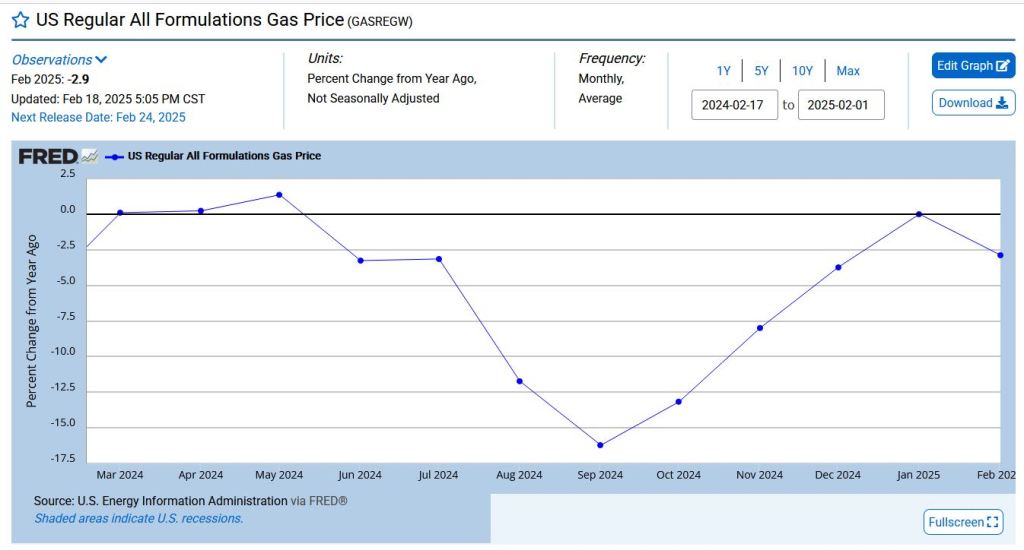

IWM stalling…much weaker than last year.

teck, the leading coal producer, now shows future energy demand falling.

-18% off high price in September.

12 week has crossed the 100 week. 100 week slope leveled.

OEX now back to 12wkma…getting ready for next down move.

Long term slope down -3.6 OR -1.4 points per month.

MBB has nice 5wk uptrend

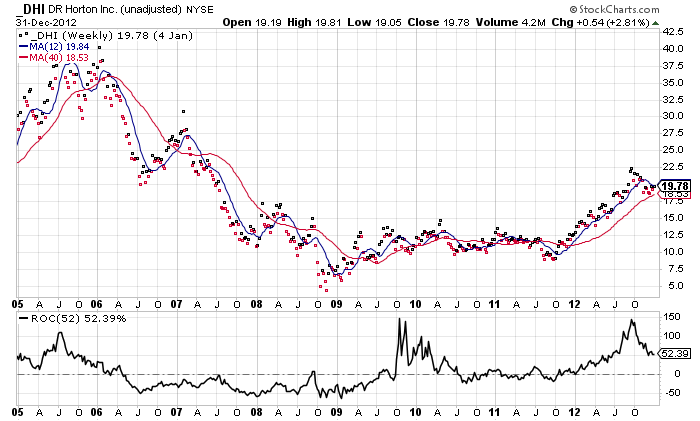

Lennar and DHI

DHI peaked in 2006 (homebuilders are leading indicators). Stocks had problems in 2007 and 2008.

Housing stocks confirm downtrend 12 wk crossing the 40 week…1st time in 2 years..

VIX still moving up…52 weeks +28%

https://str.com/press-release/us-hotel-results-week-ending-11-january

5-11 January 2025 (percentage change from comparable week in 2024):

https://www.hotelmanagement.net/operate/costar-us-hotels-report-slowest-adr-revpar-growth-4-years

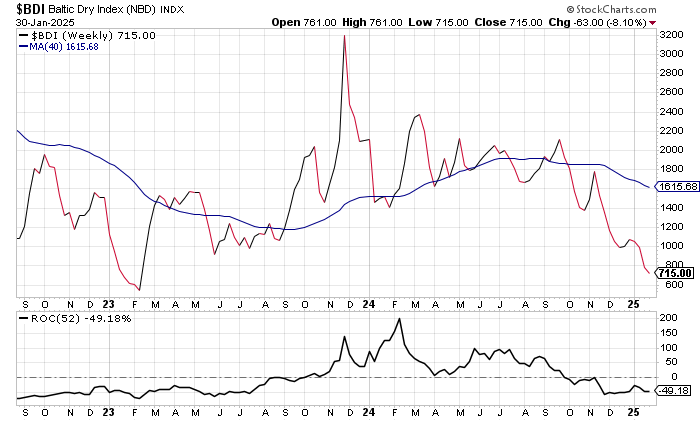

BDI in Jan 2024 +140%

BDI Jan 2025 -49%

Economy weakening…even in last quarter Q4 2024

SPY quarterly slowdown…

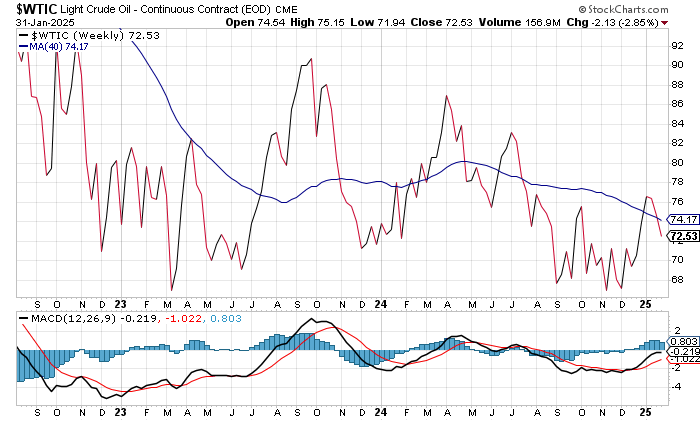

Oil back down in Jan and

M1 money supply positive for 2024 and

OEX at end of year Q4 points to bear market…below 65 like 2021…Q4 critical to the following year…

Spending will start to suffer when markets start to gyrate 10%…

ABNB had a good 2023 and 2024. BUT NOW is in bear market for 6 months…future not so bright.

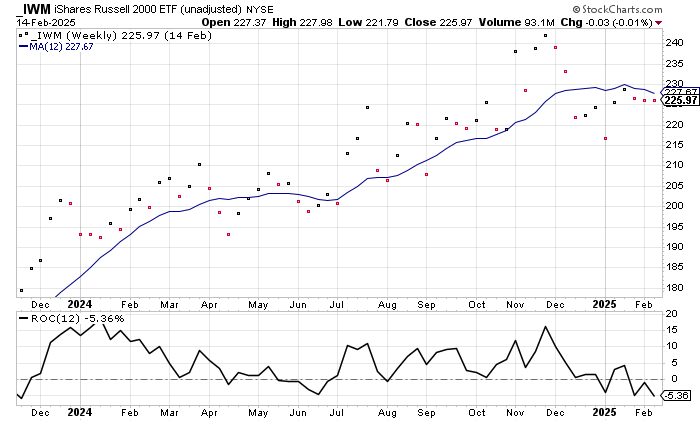

The base VIX and max VIX are shown in table below. By the end of the year base VIX will be 20.

And maximum will be VIX 30.