I have read that Inflated bubble stocks should be sold with a PEG of 3.0.

From investopedia…

What Is the Price/Earnings-to-Growth (PEG) Ratio?

The price/earnings to growth ratio (PEG ratio) is a stock’s price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period.

The PEG ratio is used to determine a stock’s value while also factoring in the company’s expected earnings growth, and it is thought to provide a more complete picture than the more standard P/E ratio.

Key Takeaways

- The PEG ratio enhances the P/E ratio by adding expected earnings growth into the calculation.

- The PEG ratio is considered to be an indicator of a stock’s true value, and similar to the P/E ratio, a lower PEG may indicate that a stock is undervalued.

- The PEG for a given company may differ significantly from one reported source to another.

- Differences will depend on which growth estimate is used in the calculation, such as one-year or three-year projected growth.

- A PEG lower than 1.0 is best, suggesting that a company is relatively undervalued.

According to well-known investor Peter Lynch, a company’s P/E and expected growth should be equal, which denotes a fairly valued company and supports a PEG ratio of 1.0. When a company’s PEG exceeds 1.0, it’s considered overvalued while a stock with a PEG of less than 1.0 is considered undervalued.

PE ratio S and P 500 29.1

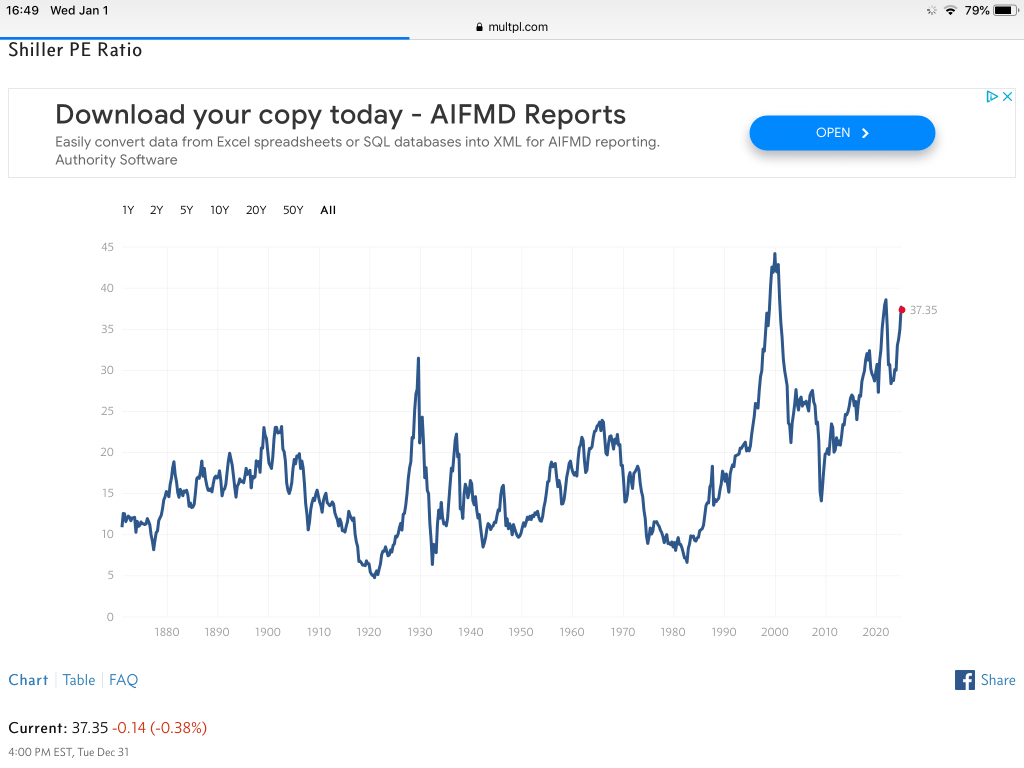

Shiller PE 37.3

Earnings Growth 5.9%

PEG ratios

12mo PEG 4.93

Shiller PEG 6.3