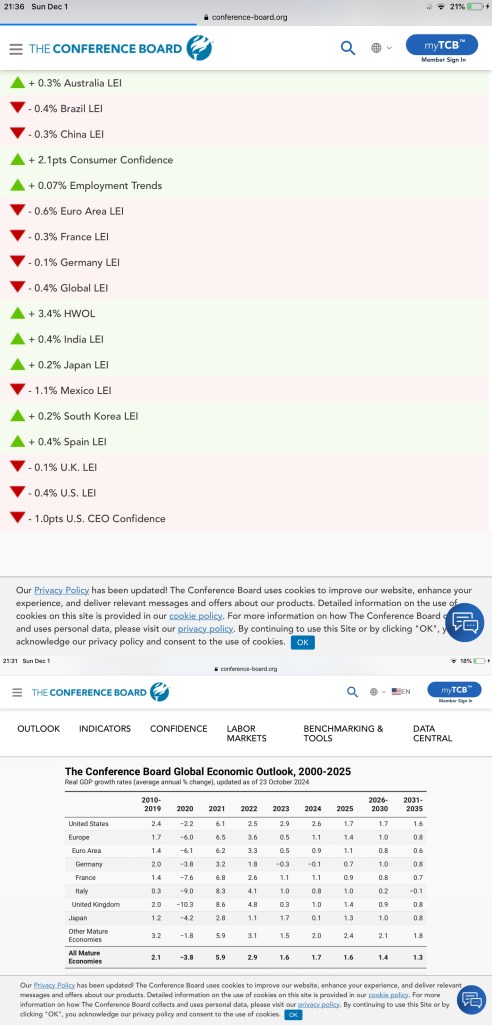

Based on 4 drops by Fed in 2025 and 8 drops by ECB…

This indicates a VERY STRONG USD in 2025.

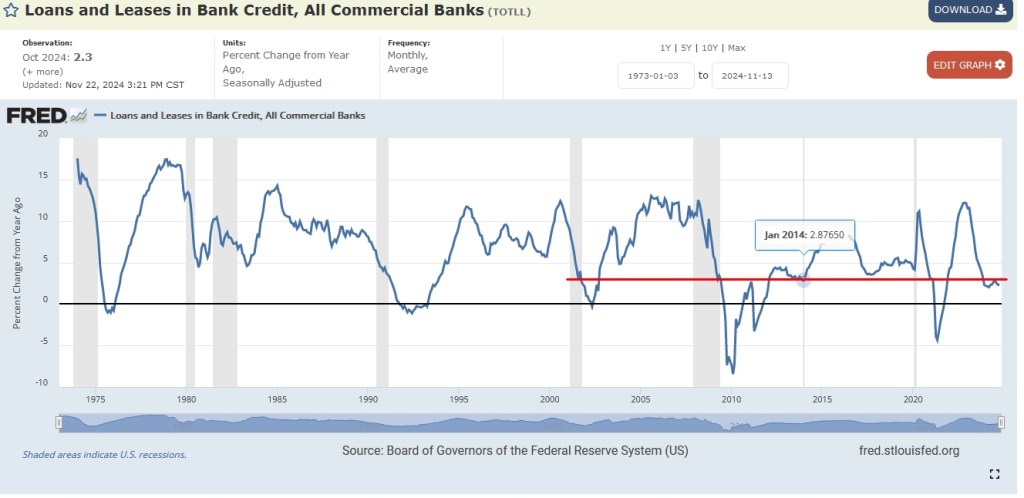

Clearly it can take 16 years to rebuild debt levels. People forget about debt during that time.

The issue of ‘forgetting’ is covered here in this documentary…

https://www.imdb.com/title/tt3332308/

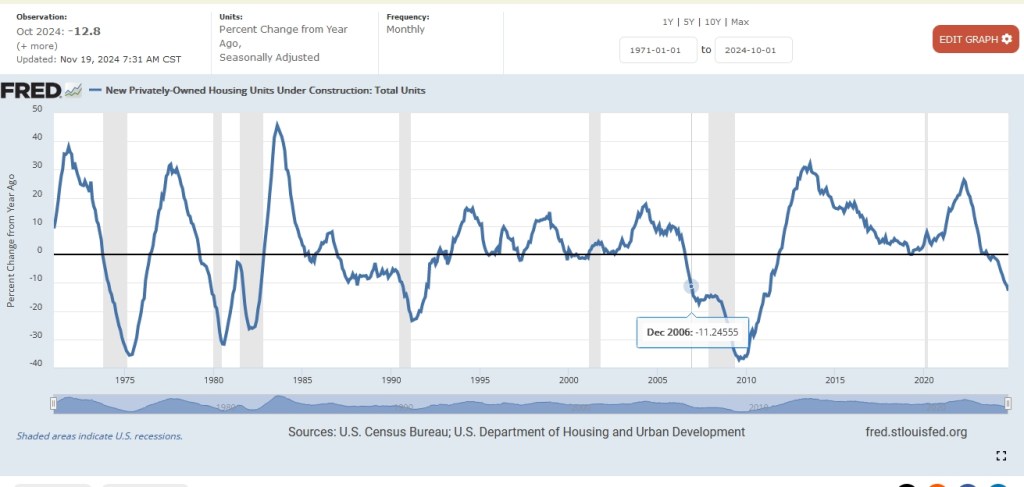

CONSTRUCTION is the key. To many, this is common sense BUT today there is TOO MUCH INFORMATION.

Hence, most are confused. Many pointed this out in 2023 as the first leg of the economy to go. Each construction job creates 3 others. When construction falls YoY (rare), recession is inevitable.

Construction Falls YoY -> Rising Unemployment -> Delinquency in Loans -> Collapse.

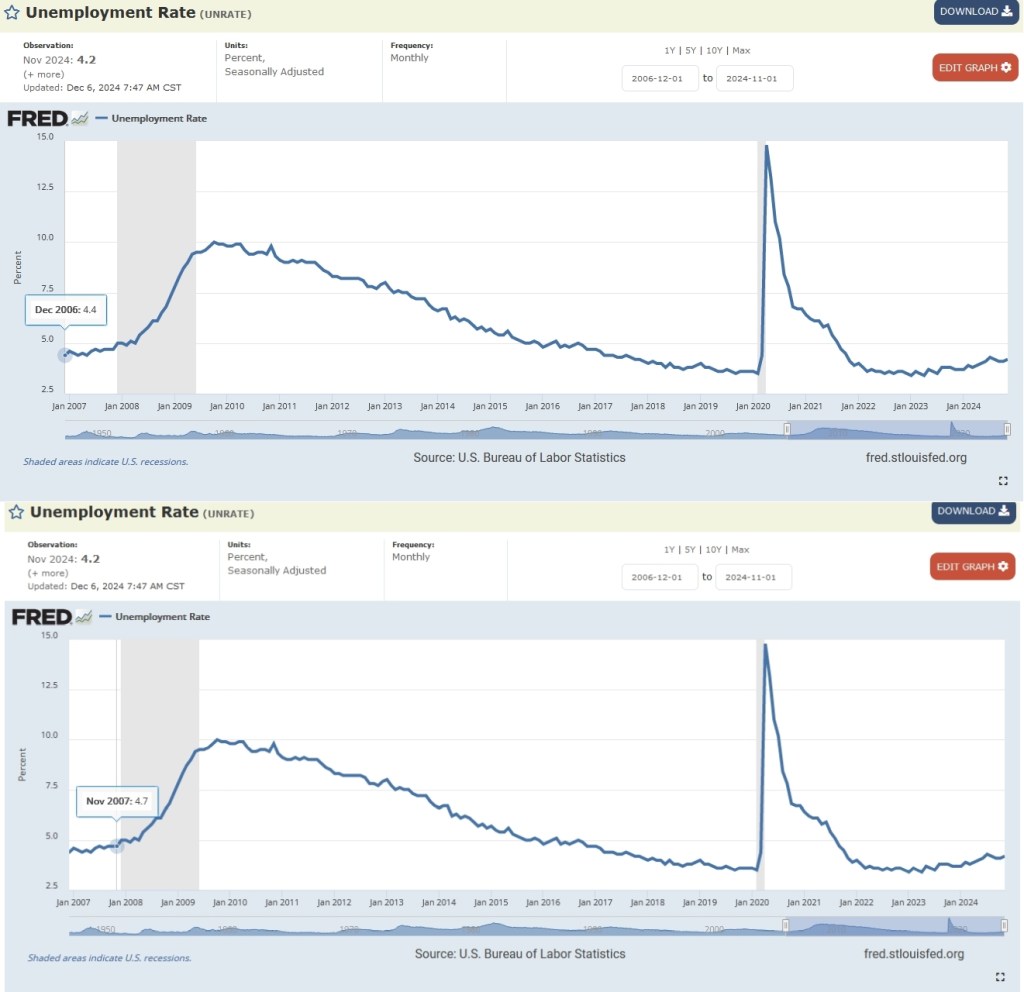

Look at the change in the UR below. It started in Aug 2023 COINCIDENT with the peak of the construction units, Aug 2023 (see construction post…)

Unemployment UR continues to move up from Aug 2023.

UR is still at 4.2% like Dec 2006. BUT moving up. UR will reach 4.8% by next Nov.

Another reason why this is NOT 2007. BUT next year is …. DUE to downturn in construction.

WHY HAS IT TAKEN SO LONG? simple.

CONSTRUCTION was TOO STRONG and unemployment too low.

BUT now weakness has arrived in 2024 and 2025 leading to recession after.

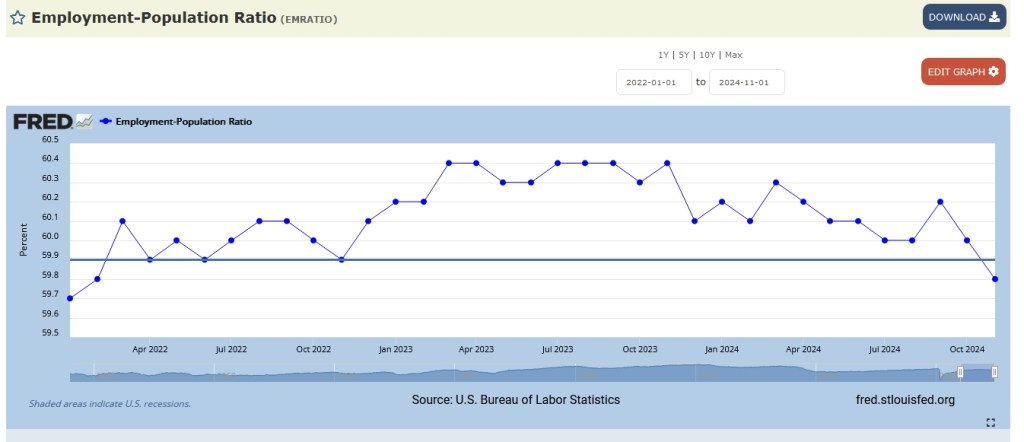

Jobs are clearly dying in 2024 despite big S&P gains.

Nov Changes for last 3 years…

2022-2021 59.9-59.3= + 0.6

2023-2022 60.4-59.9= +0.5

2024-2023 59.8-60.4= -0.6 (based on 330M popn, , -2M jobs)

Continuing UC hit a new high in Nov….

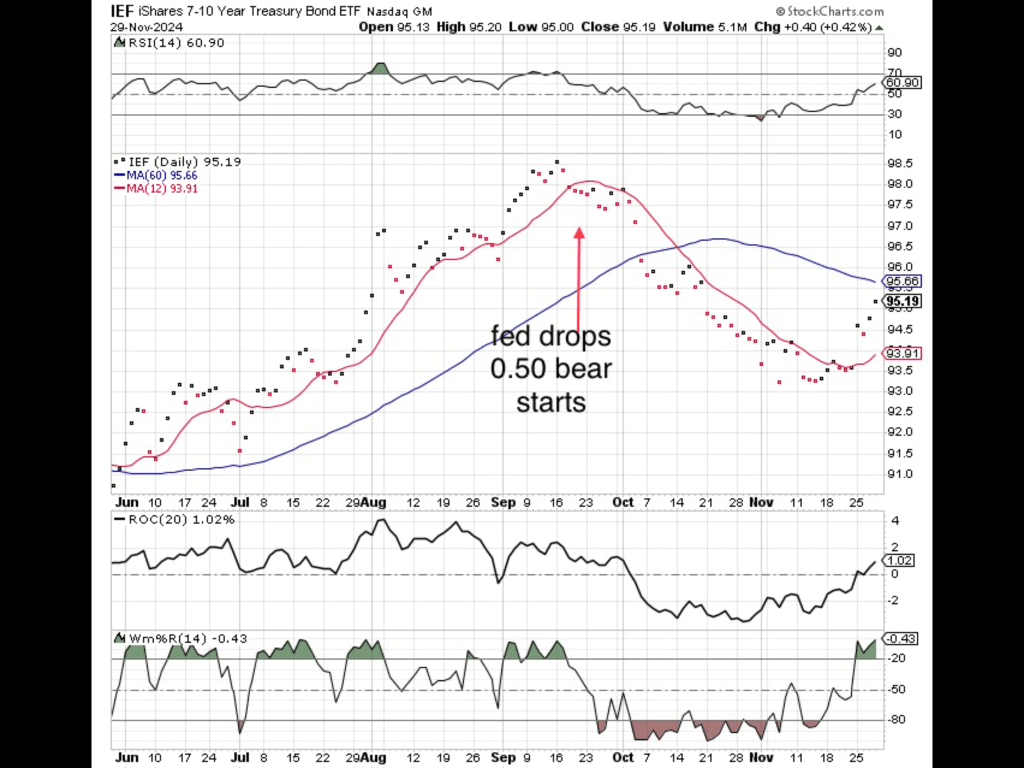

Bonds return to bull after Fed signals no drops.

World-US economy continues to weaken…

Notice how the construction market seems to figure things out a year in advance!

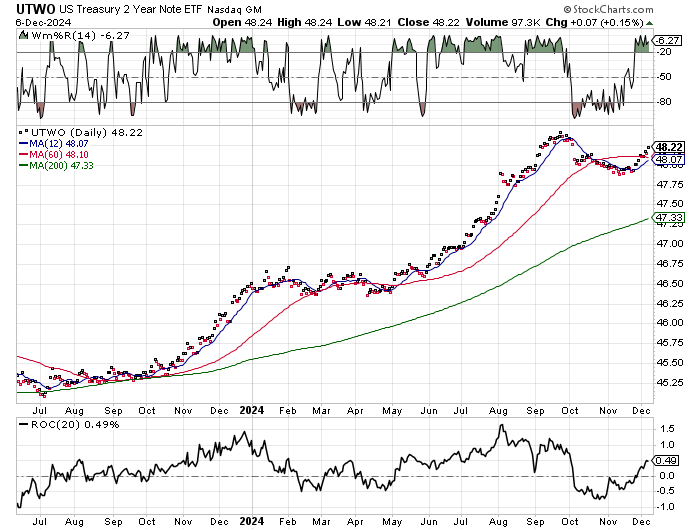

But many argue no one knows…it’s all random. The market is now at same level as Dec 2006.

The YoY increase in M1 was crossed in September…meaning weak economy and recession ahead say 2026.

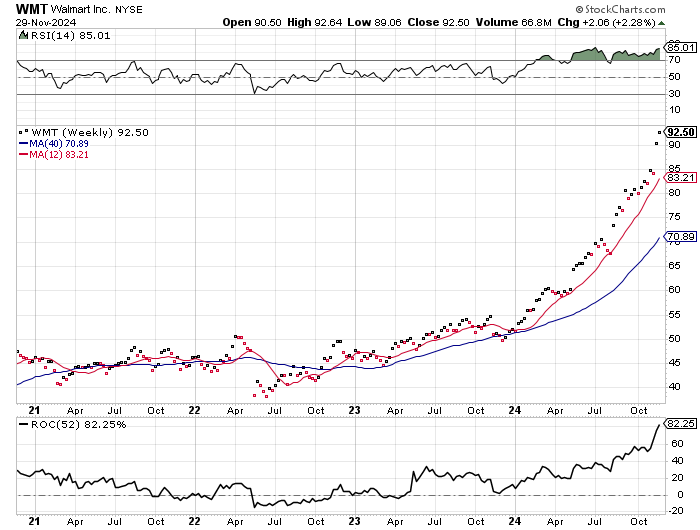

Shoppers switch to WMT to save money. High middle class are also switching. 2021-2022 economy was good…WMT flat. In 2023, WMT started rising and now on-fire in 2024. Economy now weakening fast.

Lastly forecasts by conference board are negative for 2025 for world, Europe, etc…

A lot of comparisons are made to 2008. AND most indicators are flashing recession ahead. The economy is slowing and weakening:

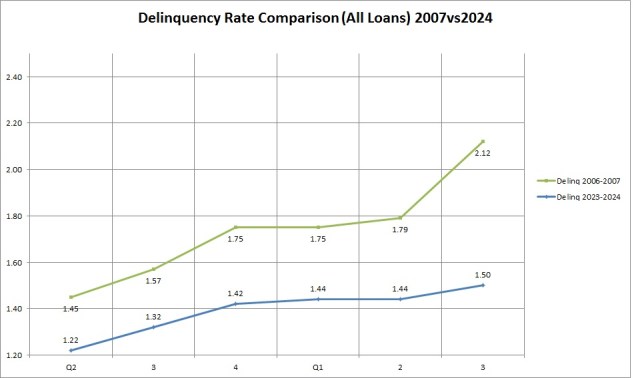

In 2007, payrolls were growing below 1%…we’re still at 1.4%. Below 1% will be next june. Notice Q3 2006 started at 1.5% delinquency rate..the same as now. Vix was 20 in 2007…now 15.

Hence, it’s a 2-3 year bear market not ONE as in 2008.

Ever since 2008, there’s been a 2 year cycle. One year down for SPY followed by 2 years up and another year of 0 or minus. In a recession, it would be 2 years down.

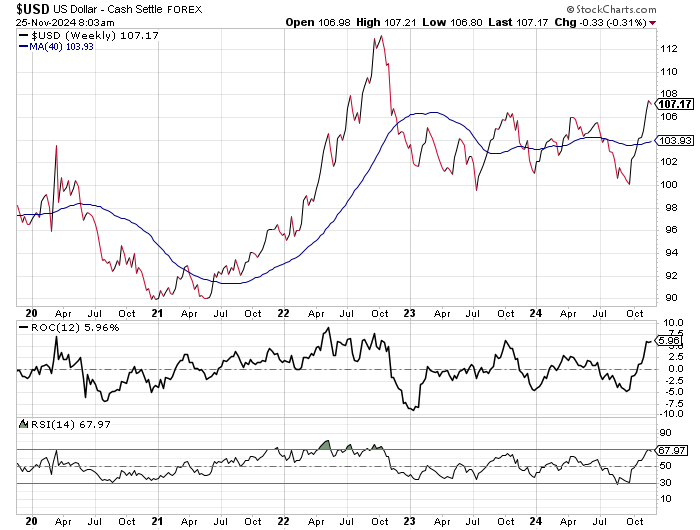

As you know, the USD has been sideways for the past 2 years. USD trend is key to market transitions. How to know you have a new uptrend? Simple USD should be Overbought on a weekly basis…

In Oct-Nov 2021, USD was OB. The following year, 2022, was a bull market in USD.

Even Sep 2014, USD became OB and USD had a bull market from Sep 2014-Mar 2016 (18mo).

As of the last 2 weeks, USD has been overbought. Hence, a new uptrend has begun for usually 2 years..

Although a 2 year bear market implies a 2 year bull mkt in USD..( Nov 2024-Oct 2026.)

It can go sideways or down a bit over the next 4 weeks before a it pushes again.