https://fred.stlouisfed.org/graph/?g=10m6s

https://www.nahb.org/news-and-economics/housing-economics/indices/housing-market-index

This is single family only I believe…so may have to check multi-family. Case-shiller YoY price movement gives same results.

Peak was Apr 2006 and bottom was May 2013 or 7.2 years (the often quoted real estate cycle). Current peak was Jul 2022 so bottom will be Jun 2029?

Case-shiller was delayed 1 year (2007) but was early on the buy side (2012). So Case-shiller may indicate to buy in Jun 2028.

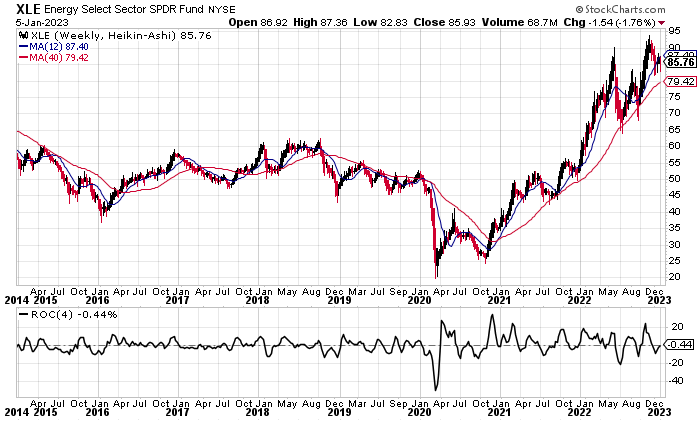

Despite QE and stimulus …all reflected in XLE !

For TLT, two considerations-

When year over year case shiller turns negative…bear market real estate. When it crosses to positive…back to bull.

Real estate is the primary asset of middle class and reflects true state of consumer confidence and economy.

After credit cards started growing again in Jan 2012, real estate picked up 1 year later. And stocks picked up Jan 2013.