Manufacturing ism prices paid drops significantly for first time in a year…

https://fred.stlouisfed.org/graph/fredgraph.png?g=CcIe

The reason core inflation dipped in Dec and Jan is the drop in shelter inflation. But now as things open up again, shelter inflation rises.

The blue line shows the oer rate needed (0.25) to achieve core inflation 2.0.

As expected after 6 months unemployed, delinquency rates move up. Usually loans go delinquent and then LTU (long term unemployed) goes up. For this time unemployed are driving delinquency up. Looks like delinquency has a long way to go up as stimulus payments delay it.

Note change to fed policy in Jan 2018 and Sep 2018. Then again in Nov 2019 dips and change happens the next meeting Dec 2019.

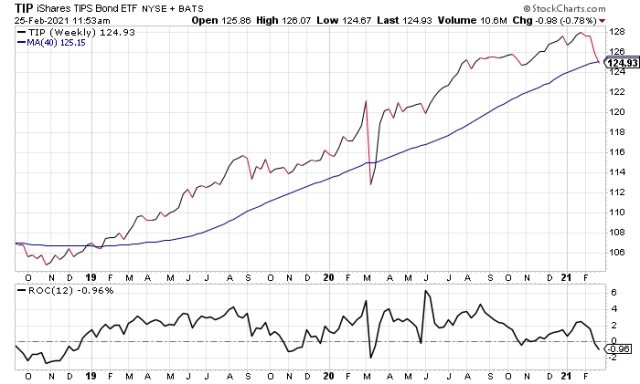

And now another dip in the TIP…

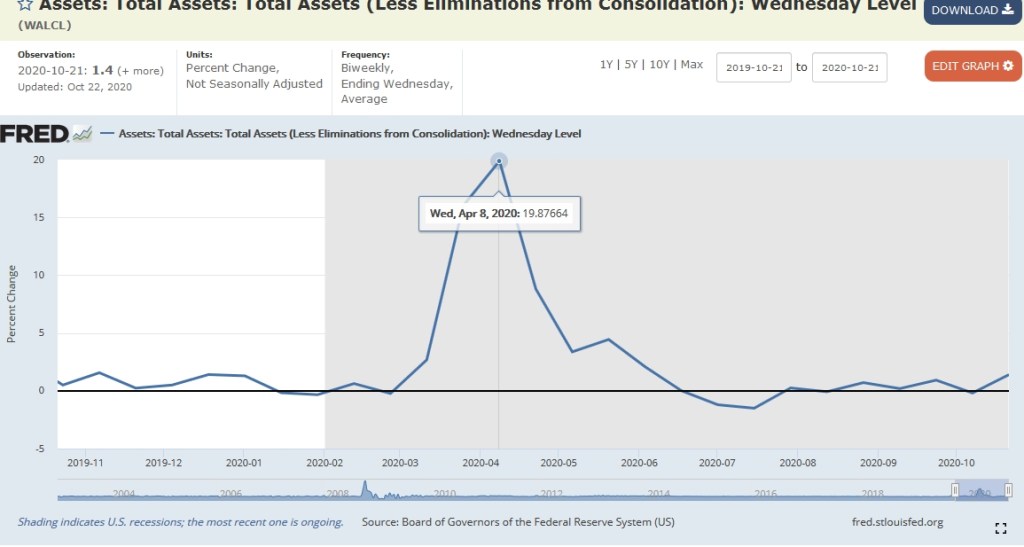

See on secondary indicators…percent change over 2 weeks

Fed balance sheet peaked April 8 and started ramp up on March 11….

As of Dec 2019, job openings decline by 14% YoY.

But from a higher level than 2006,

2 quarters away from reaching 2007 levels…

And world trade volume shrinking July and Nov 2019 (-1%)…

And baltic dry index fell to new recent low. The 40wkma is now pushing down.