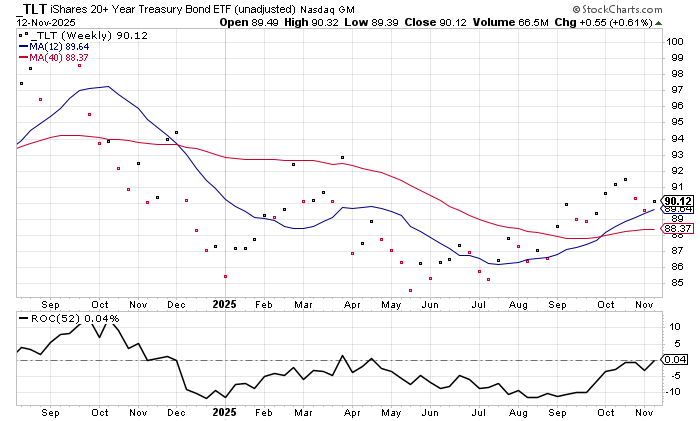

still above 12 and 40 wkma…both slopes up. Last year same time was a big downward slope.

ROC 52 is positive. Push to 92 by 2nd week Dec.

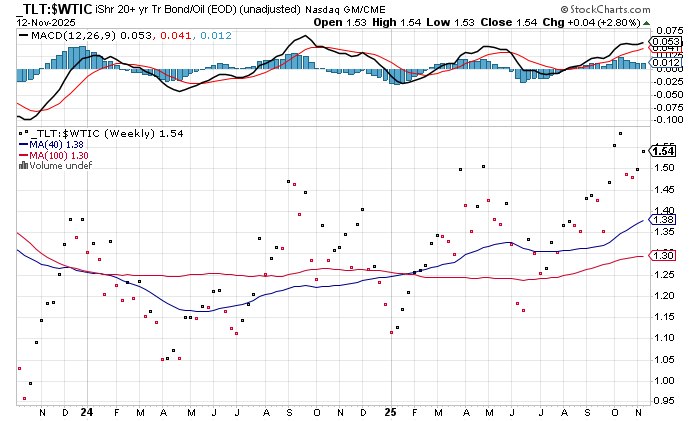

TLT to oil bullish since August…

Guess the guy behind this speech?

“Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Happiness lies not in the mere possession of money; it lies in the joy of achievement, in the thrill of creative effort. The joy and moral stimulation of work no longer must be forgotten in the mad chase of evanescent profits. These dark days will be worth all they cost us if they teach us that our true destiny is not to be ministered unto but to minister to ourselves and to our fellow men.

Recognition of the falsity of material wealth as the standard of success goes hand in hand with the abandonment of the false belief that public office and high political position are to be valued only by the standards of pride of place and personal profit; and there must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing. Small wonder that confidence languishes, for it thrives only on honesty, on honor, on the sacredness of obligations, on faithful protection, on unselfish performance; without them it cannot live.

Restoration calls, however, not for changes in ethics alone. This Nation asks for action, and action now.

Our greatest primary task is to put people to work. This is no unsolvable problem if we face it wisely and courageously. It can be accomplished in part by direct recruiting by the Government itself, treating the task as we would treat the emergency of a war, but at the same time, through this employment, accomplishing greatly needed projects to stimulate and reorganize the use of our natural resources.”

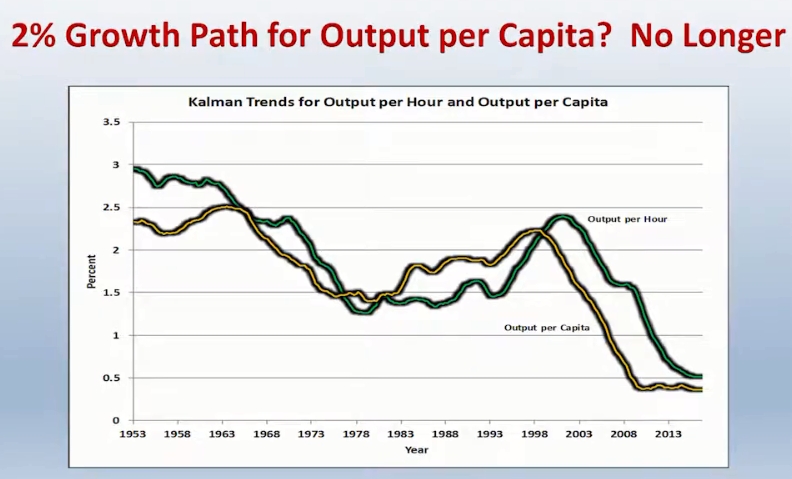

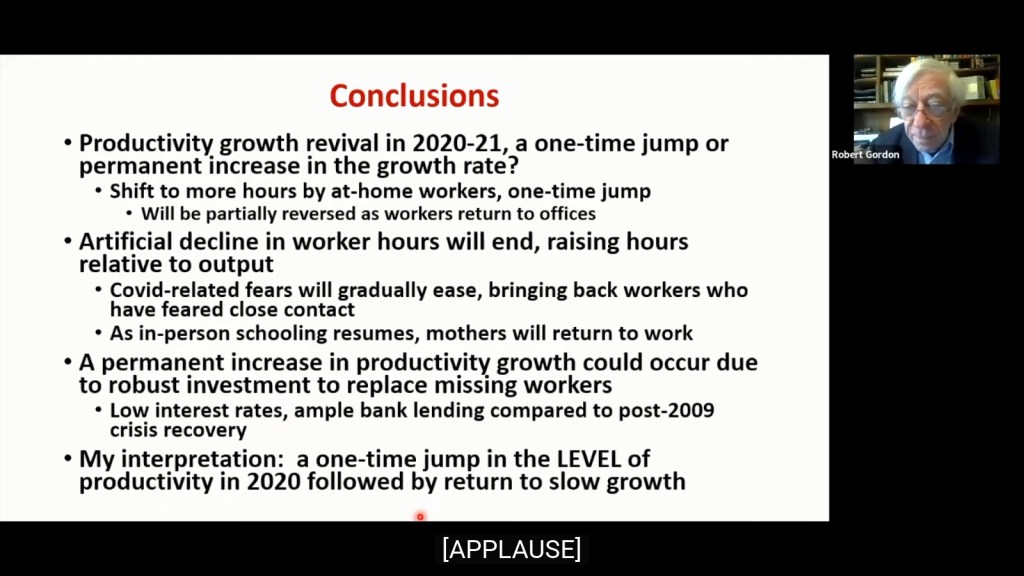

And weaker yet in 2026 ….0.5% growth.

This also says SPY will be 0% next year as growth is dying and Fed drops on pause in Dec.

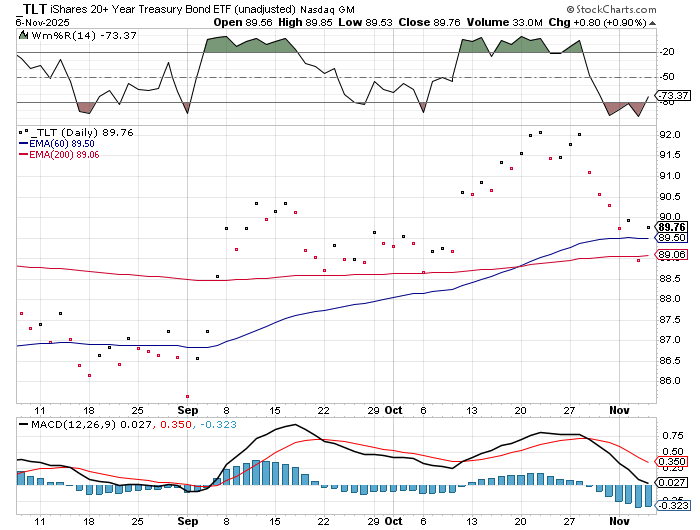

TLT reflects the Fed pausing in December and having a downward reaction -2.5.

BUT is now due to go sideways 90-91 during November. Push to 93 or 93.50 in December.

TLT now has an upward slope in Sep and Oct.

Looks like Fed is becoming worried about this parabolic behavior of tech stocks.

Hence, why no drop in Jan…regardless of rising unemployment or lower inflation.

Tech and Gold stocks thought rising unemployment was great for them as Fed would drop rates downwards in a straight line.

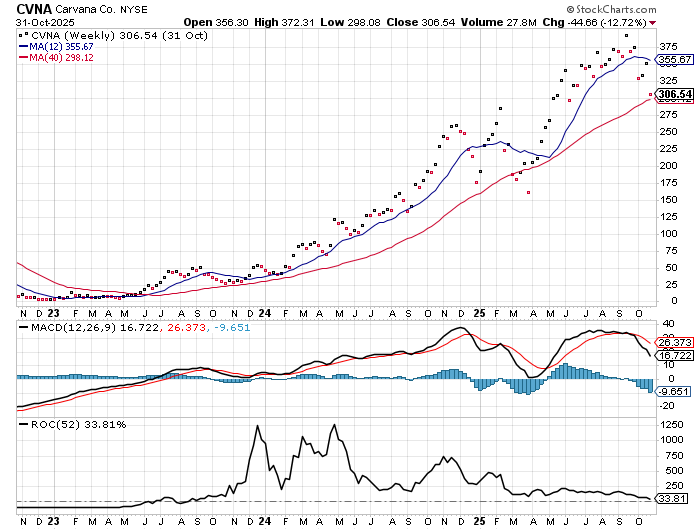

In Oct, drop was -18%. And there was a big signal the last 2 weeks of Feb before the big drop in Mar-Apr -42%. Last year ytd Oct +390% and this year +61% YTD.

Notice it slows in Aug then sideways Sep then fall -18% in Oct…

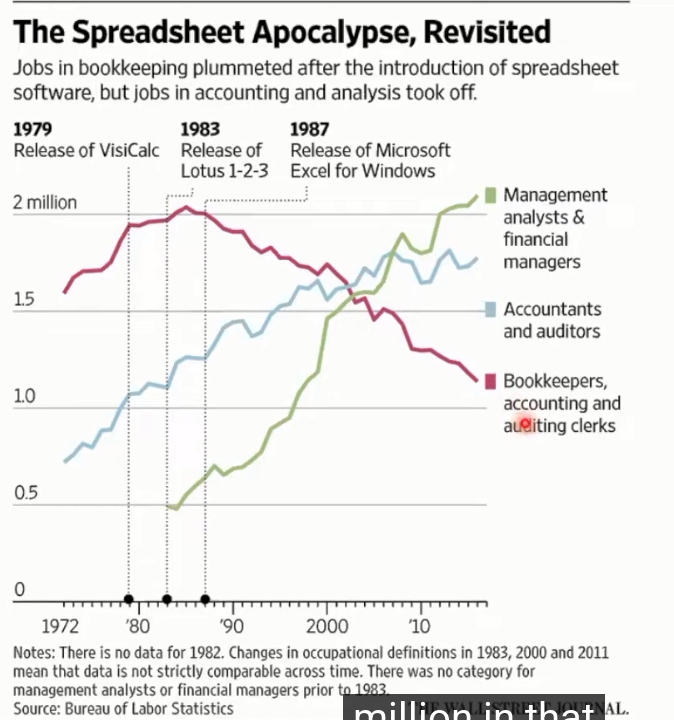

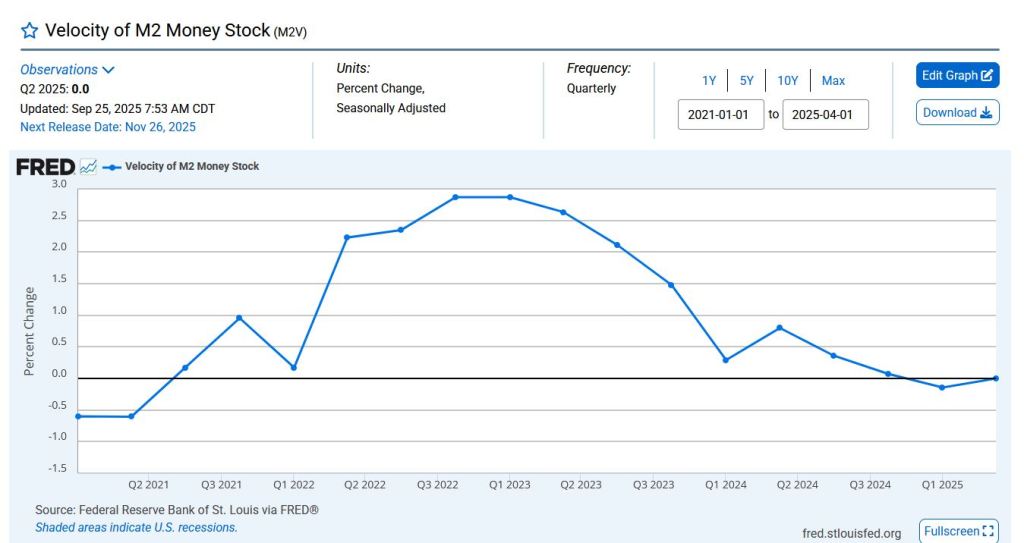

OF COURSE, money velocity has died from the peaks of 2022!

With large debts and high prices, asset deflation over 3 years is the outcome

with many prices also deflating. CPI deflation will occur at the end of 2028 just before QE.

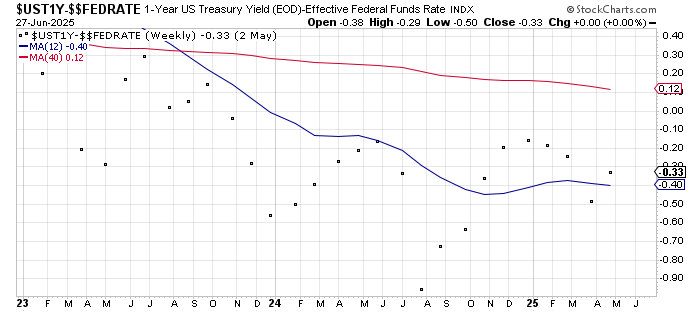

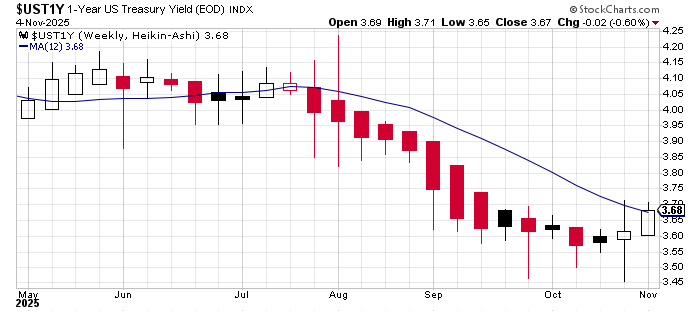

New FR 3.83

so -0.1 is 3.73.

Upside almost over but will last 4-5 wks before resuming downtrend.

The gap between Fed rate and 1 year Treasury can close to -0.1.