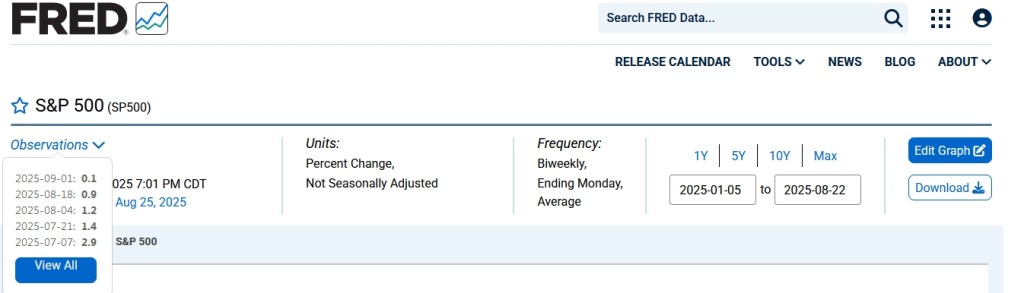

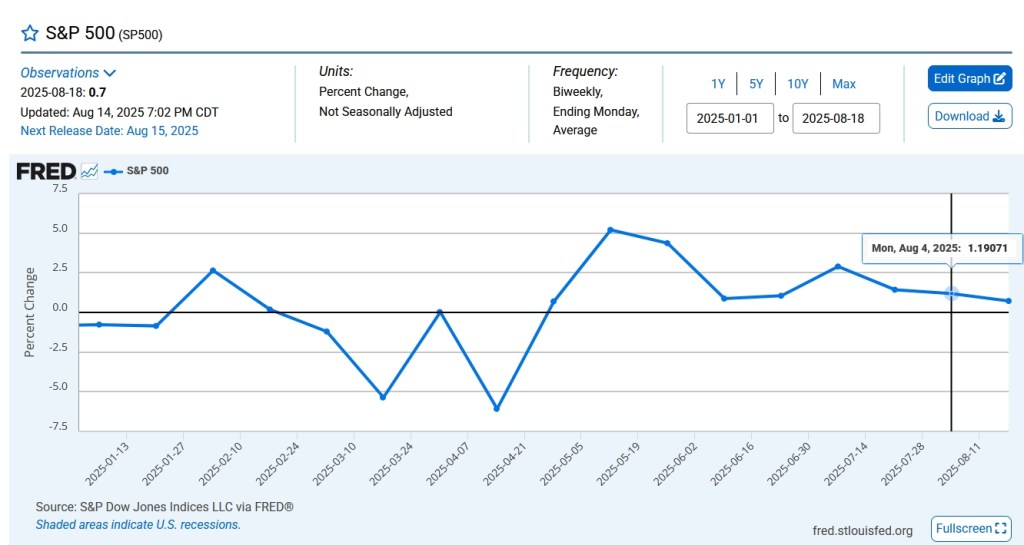

200 dma points up again in August…

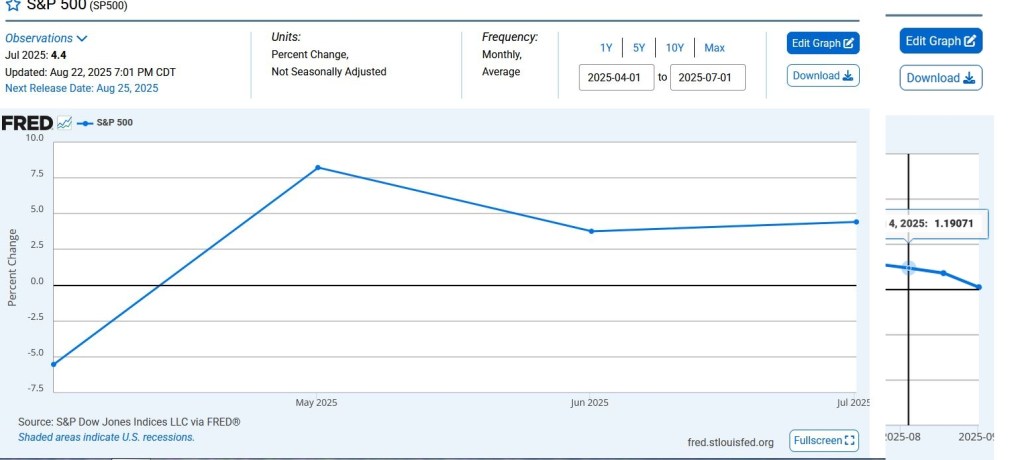

May-Jul weakness ends. SPY will start to have trouble.

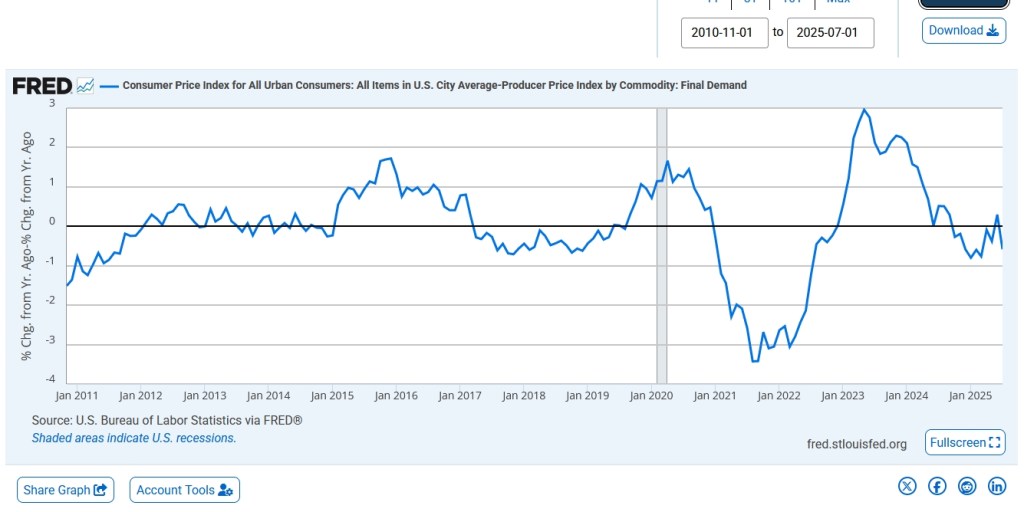

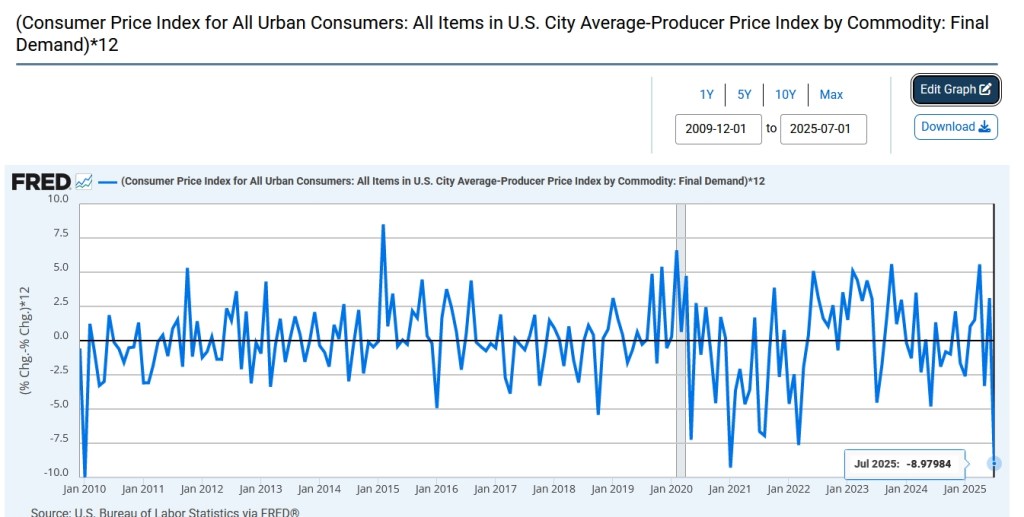

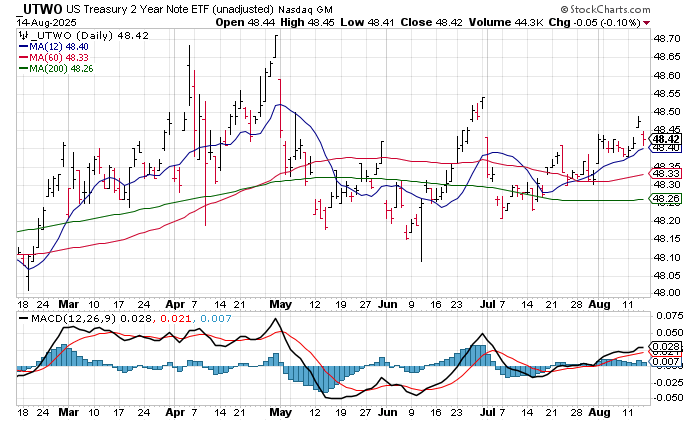

In Feb, bonds started to move up ROC60 + and trouble happened in SPY Mar and Apr (Earnings’ Season).

When SPY has big trouble, it’s in earnings’ seasons.

IEF also up near breakout of 96.50