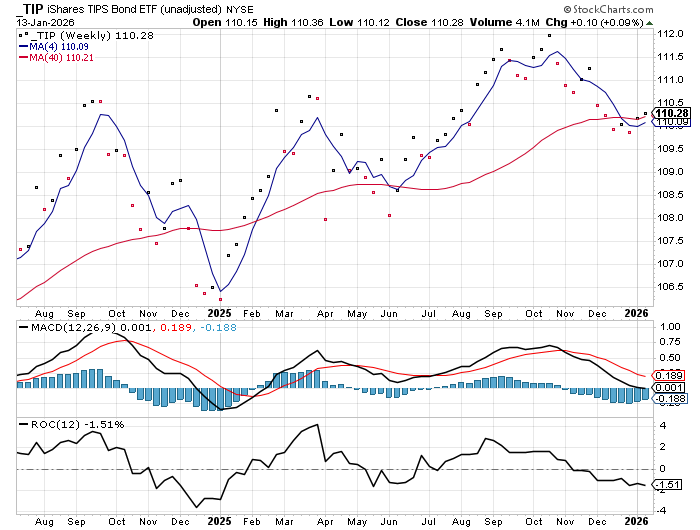

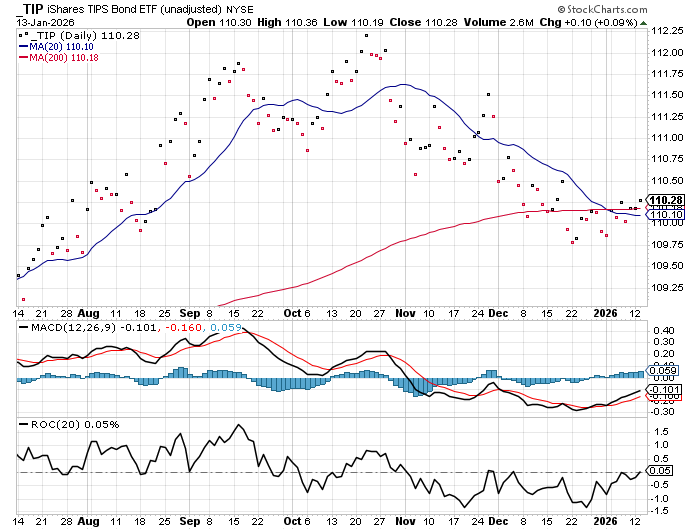

Last 6 months…

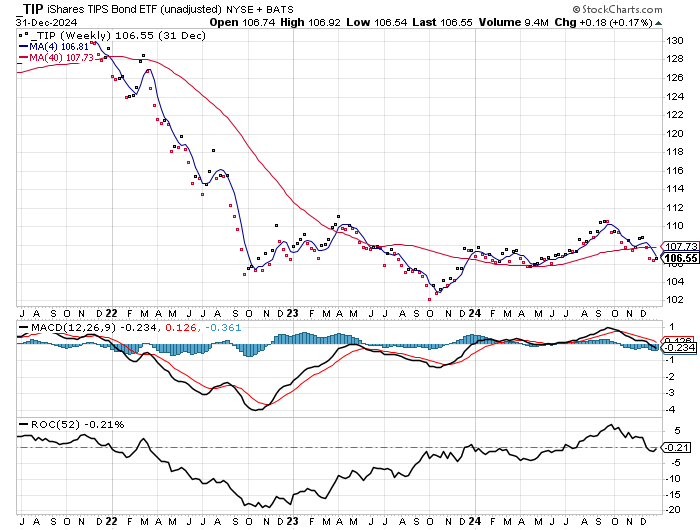

AND before…2022-2024 strong economy. 2025 weakness starts..

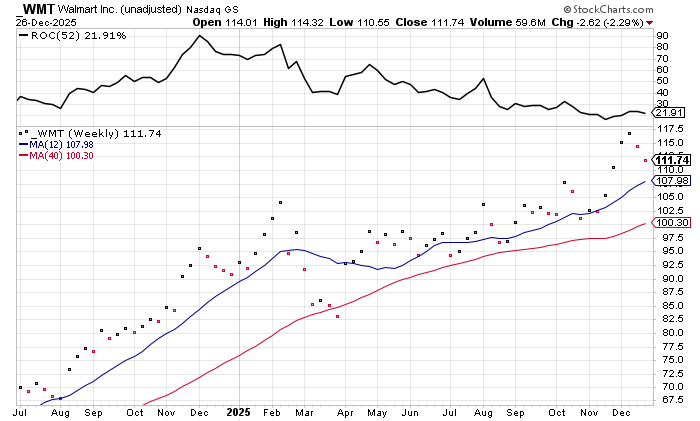

OR 0.3 of last year…so next year +7%.

When the stock surges big one year…the increase drops big the next year.

Euro starts to move up…weakening US economy. Growth started to falter in 2025….