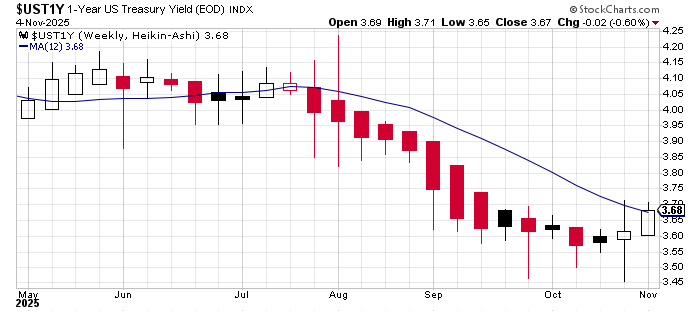

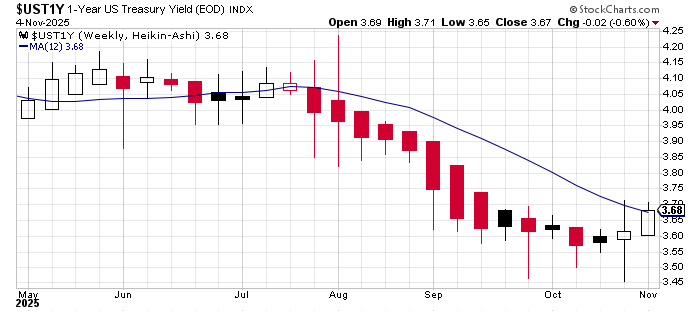

New FR 3.83

so -0.1 is 3.73.

Upside almost over but will last 4-5 wks before resuming downtrend.

The gap between Fed rate and 1 year Treasury can close to -0.1.

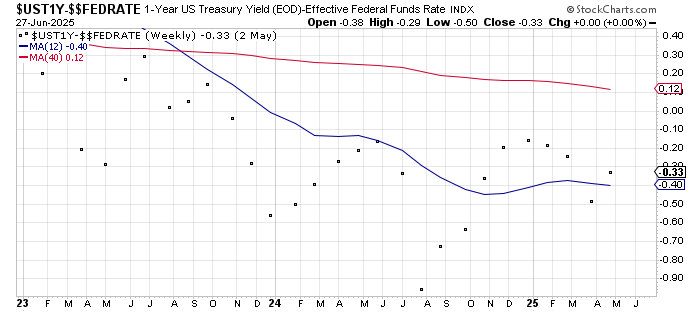

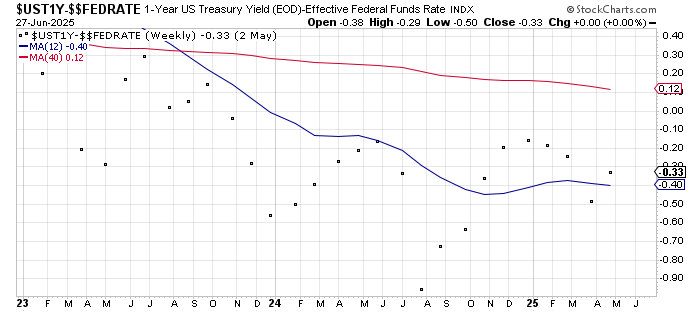

New FR 3.83

so -0.1 is 3.73.

Upside almost over but will last 4-5 wks before resuming downtrend.

The gap between Fed rate and 1 year Treasury can close to -0.1.

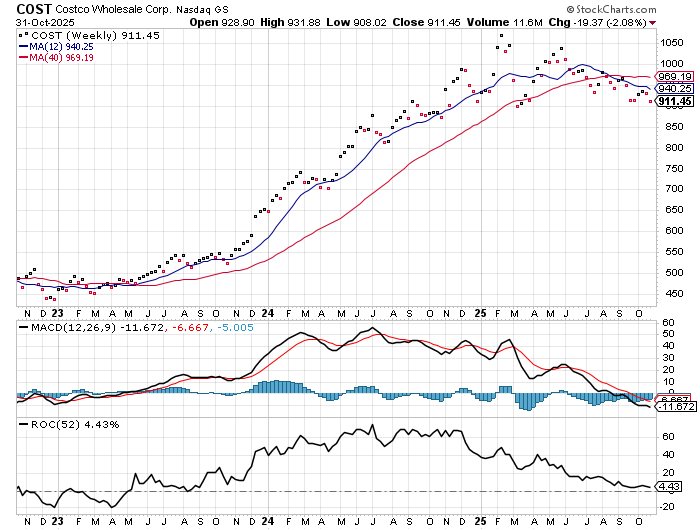

Costco represents top 50% spending in America as many doctors/medical and lawyers also shop there…

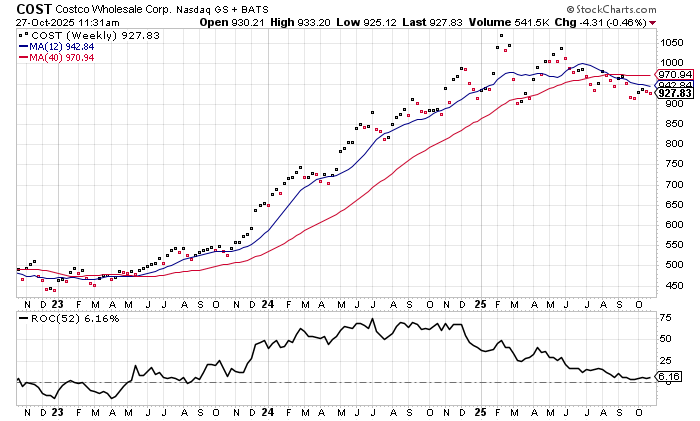

Last year in December Costco was up +35% YoY.

Of course, economy was booming in Q1 2025! And for most of 2025…

OEX loses momentum last 8 weeks…best days of August are over AFTER the rate drops…

Looks like Fed doesn’t want to spend their “bullets” that fast.

Market was wrong…no straight line drops!

I suspect that’s why you get a 0% in SPY next year and it makes sense.

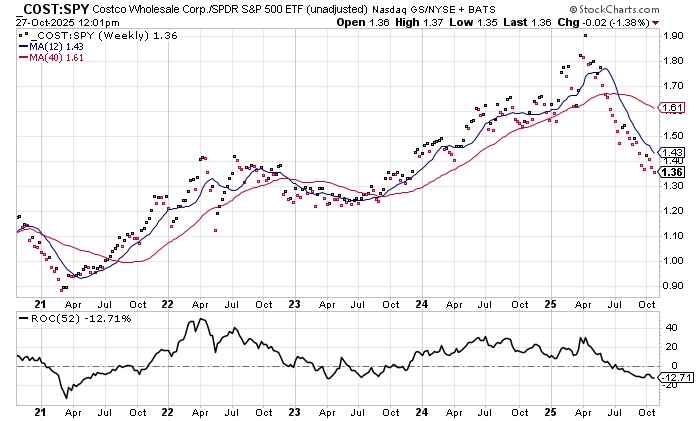

When economy is weak (compare COST +35% 2024 to now +6%)

and Fed pauses…WATCH OUT!

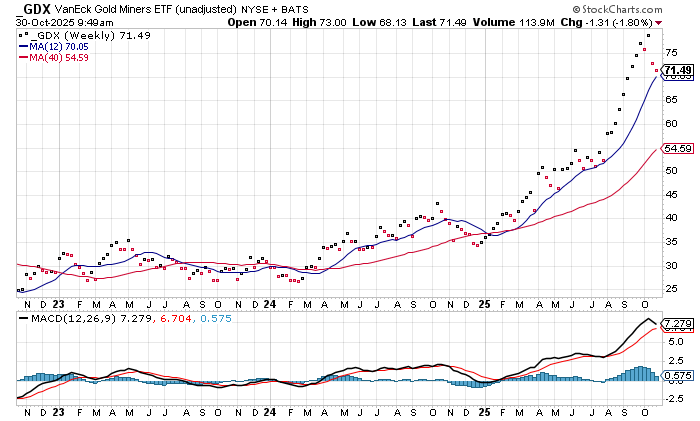

This explains GDX collapse last week as well…

Also note last week Fed Futures was wrong…it said 57% for drop and 41% for pause.

Now look…even their table about last week is indicated WRONG!

GDX showing a rising deflationary force…

The best days of gold are behind it…SPY and GLD returns and estimates…

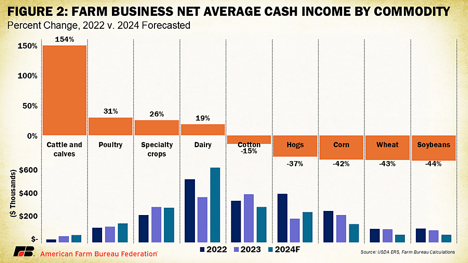

Here is what Conterra, an agricultural lender, had to say:

“Lenders are reviewing everything from crop budgets to collateral before backing loans. Results from the American Bankers Association’s 2024 Ag Lender Survey show that just 58% of farm borrowers are projected to remain profitable this year, down sharply from 78% in 2023. That drop reflects a mix of pressure points: softer commodity prices, lingering cost inflation, weaker off-farm income in many rural areas, and increasingly erratic weather.”

Farmers are having a much harder time finding a bank to refinance their loans when they come due, if they lack the capital to repay in full. This is often when the family farm is lost.

Farmers usually borrow at the start of the growing season to buy inputs and replay their loans when they sell their crops.

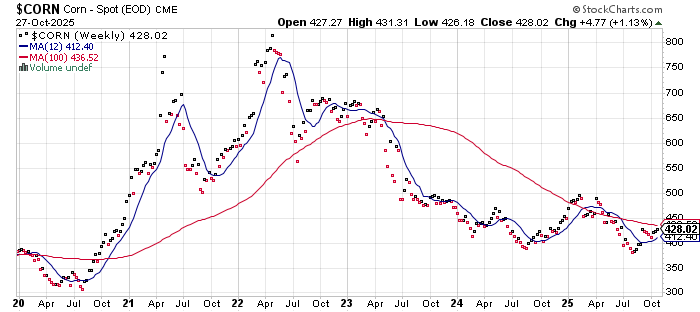

However, in 2025, farmers expect to lose $100 for each acre of corn they grew. Soybean prices are also down significantly.

And 160,000 farms have been lost between 2017 and 2024, according to the USDA. Many more losses are on the horizon.

Other good links…

Cattle highest income now…but also high price…

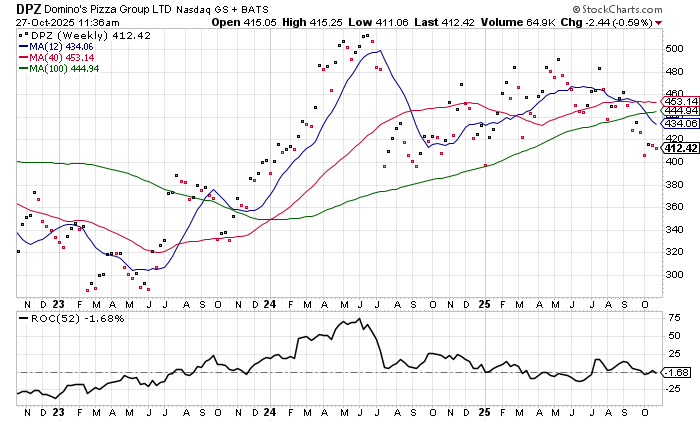

Domino’s bear market since September…

Costco bear market as of August…

consumer under pressure including high end as many shop there now…

Ratio to SPY…leading

Domino’s below 100wkma…

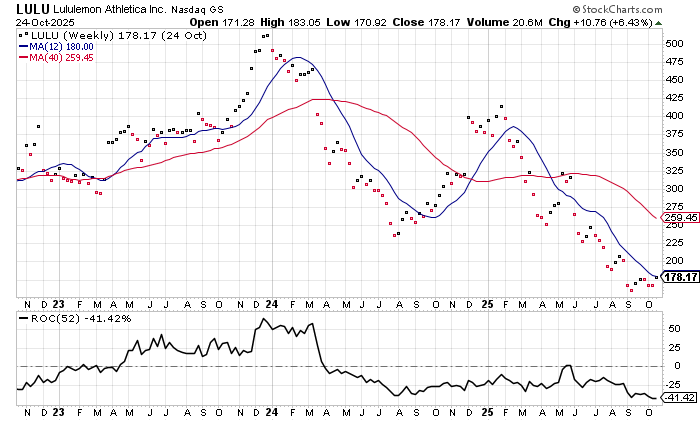

Urban elite also have less…LULU down again since June…

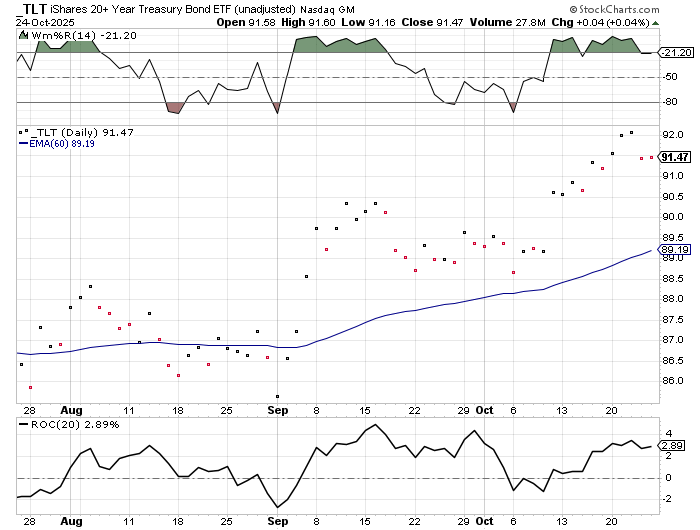

60 day points up nicely…and williams stays mostly in the green.

NOW also change, inflation will stay sideways at 3% next year with 3 big monthly up and downs.