-

Recent Posts

Archives

-

Other Indicators

-

Longer Term

The cycle is 2026-2028.

SPY has slowed down from July but will be up 15-16% for the year…

Economic Growth will be lower next year 0.5%. It has fallen 0.6% since April.

A house of cards falls off the cliff suddenly.and usually in an election year.

Rate drops are pushing it up. all emas are moving up. The 60dema has crossed the 200 dema.

Close to YoY positive as well..

starting to outperform spy…

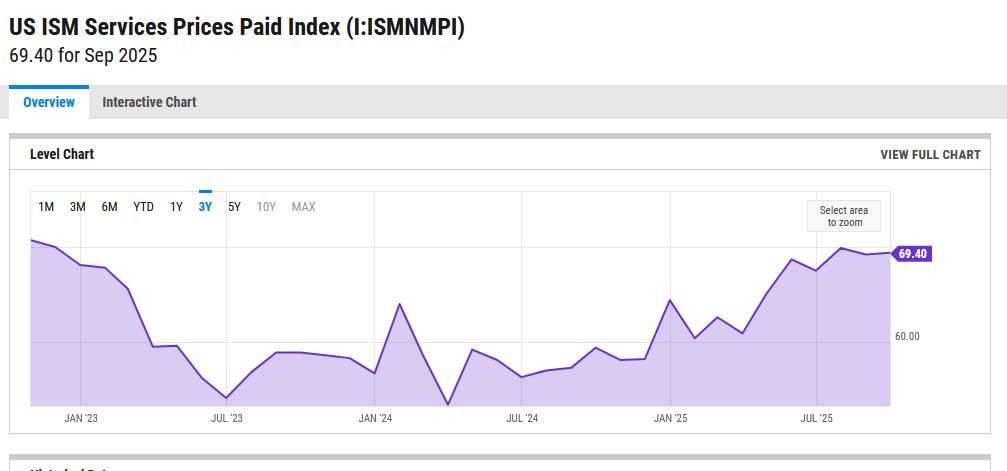

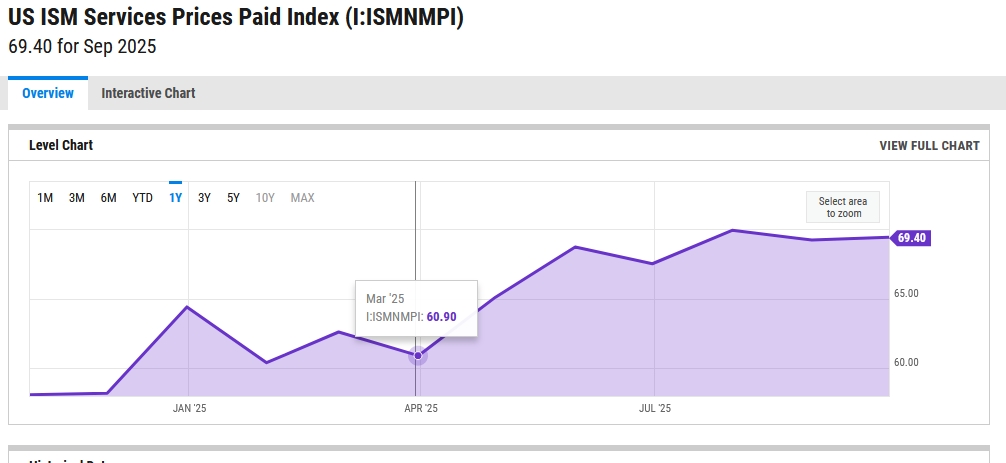

See services ism prices the last 3 years….

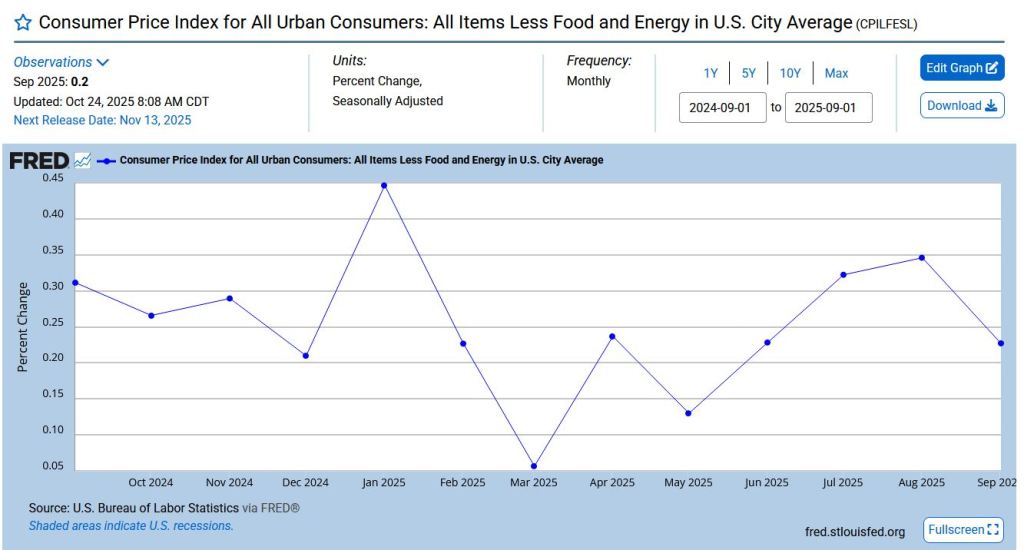

And services inflation was low with stocks from Feb and Mar but then accelerated….

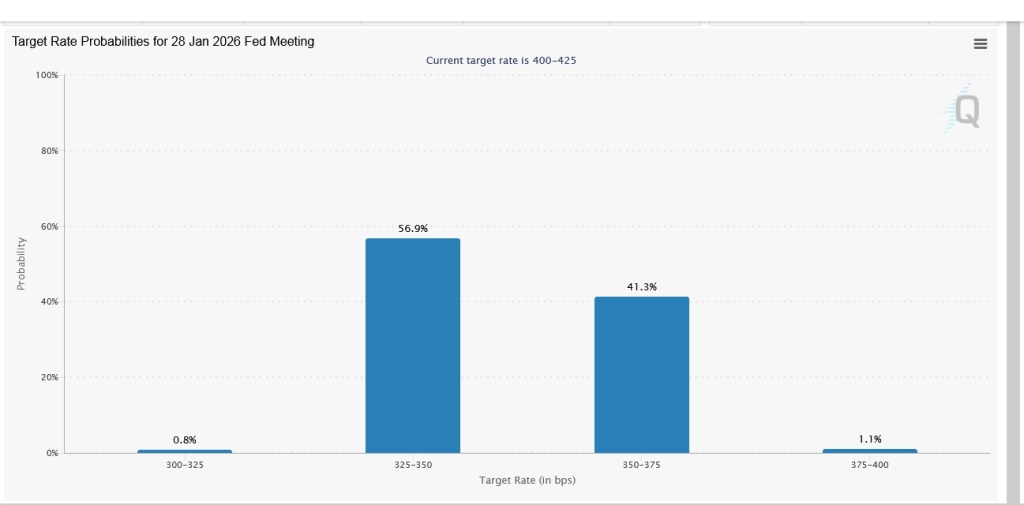

And even Fed Futures is split….